Market Highlights

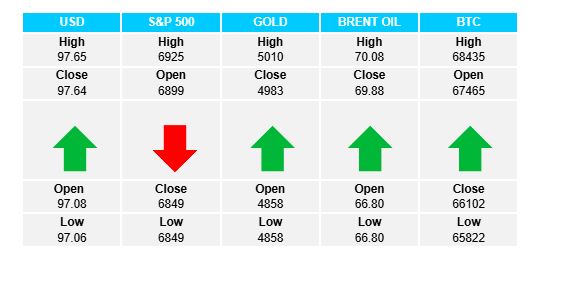

1 - US stock markets close down on the day. S&P -0.33%, DJ -0.57%, NASDAQ -0.36%

2 - European markets also down. DAX -0.83%, FTSE -0.77%, IBEX -1.03%

3 - Gold shows slight gains, up 0.49% at $5022; Silver up 1.66% at $78.24

4 - Brent oil rallies on US/Iran tensions, up 2.59% at $71.44. Bitcoin edges slightly higher at bottom of recent range, up 0.96% at $67K

5 - USDX confirms demand for USD, up 0.14%, EUR -0.14%, GBP -0.18%, JPY +0.18%

Daily Price Activity

Insights

USD INDEX Buyers added to the uptrend with a higher high and higher low on the chart. The Asian and European sessions saw the initial push higher, followed by a gentle retracement and leveling off through the US session. Trump’s aggressive rhetoric towards Iran, coupled with positive data (jobs and inflation numbers) adding to the demand for the global reserve currency. Buyers will target above 98.00. Resistance at 98.01 with support at 97.51.

S&P 500 Yesterday’s rally was short-lived as sellers confirmed a red candlestick for the 7th of the past 8 trading days. Today’s close at 6874 marks the 6th consecutive close within the established 6850 - 6900 range. The markets continue to trade nervously with volatility in both directions. The feel has a bearish tinge at this point. Resistance at 6912 with support at 6845.

GOLD Buyers edged out a slight gain on the day, yet unable to maintain above the $5000 level, or reverse the current downtrend. Gold’s resilience was reflected in the metal’s ability to hold it’s ground as the USD strengthened - not the traditional inverse relationship. The broader sideways activity has been in place in spite of the US/Iran talks. Should rhetoric evolve to physical activity, demand for the safe haven commodity should see prices break to the upside. Resistance at $5022 with support at $4962.

BRENT OIL The volatility which characterizes the oil market saw a 2nd consecutive day of strong buying as Trump’s aggressive stance re. Iran created demand for the commodity. Current prices above $71 are reaching levels last seen in July 2025. Barring an unexpected agreement between the 2 countries, upside moves continue to be the default direction. Resistance at $71.49 with support at $69.67.

BITCOIN Technically buyers won out today ensuring a green daily candlestick. A bounce up off current lows confirmed buyers continue to guard the support area, for now. However, the flip side shows a 5th consecutive lower high on the chart, adding to the descending triangle pattern (bearish signal) - $68K level caps the top of the triangle. Sentiment tilts to the downside with lack of demand continuing to stifle intraday bouts of buying. The noticeable narrowing trading range signals an imminent break out is brewing. Resistance at $67.3K with support at $65.7K.

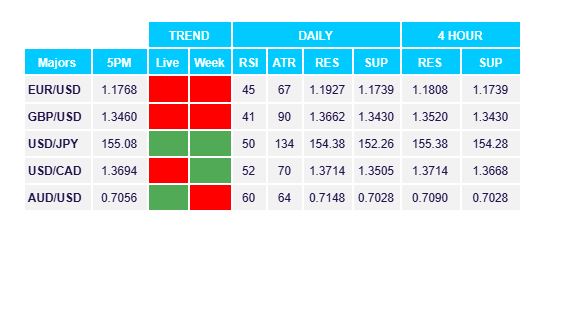

FX Pivot Levels