Market Highlights

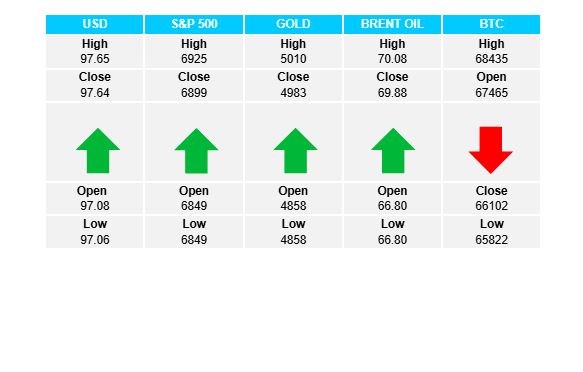

1 - US stock markets closed up on the day. S&P +0.65%, DJ +0.38%, NASDAQ +0.91%

2 - European indices confirm demand with solid gains. DAX +1.15%, FTSE +1.23%, IBEX +1.35%

3 - Strong day for metals. Gold up 2.64% at $4985; Silver +7.06% at $77.31

4 - Brent roars back confirming demand for oil, gaining +4.69% at $69.98. Bitcoin edges lower for 4th consecutive day, down 2.08% at $66.2K

5 - USD rallies on all fronts. USDX +0.63%, EUR -0.55%, GBP -0.45%, JPY +1.09%, CAD +0.43%

Daily Price Activity

Insights

USD INDEX The USD added to recent gains with a significant rally across the board. The index confirmed and added to the uptrend with the leading indicator (EMA) pulling away sharply. Next upside target will be 97.86 (Feb 5th 2025). Today’s candlestick reflects the 6th consecutive higher low on the chart. Resistance at 97.64 with support at 97.05.

S&P 500 Notwithstanding the volatility late in the session, buyers secured a solid fightback, breaking above, and more importantly, maintaining above the recent highs. Technically the downtrend still remains intact. Noteworthy that US equities strengthened alongside the USD, rather than the traditional inverse relationship between the 2 major assets. Further, buyers have continued to guard the current support area since the start of the year. Resistance at 6926 with support at 6847.

GOLD In keeping with the USD and equities, gold joined the rally with a push higher from the open, eroding yesterday’s losses. Buyers will aim to maintain above the $5000 mark with $5100 the next upside target. The downtrend remains in place as sellers will look down to retest the $4900 support area. While the sideways activity continues, and the next break could be in either direction, the commodity’s safe haven status is not in question. Resistance at $5011 with support at $4857.

BRENT OIL Buyers stepped in at the start, recouped yesterday’s losses and went on to retest the $70 resistance levels. The Geneva talks again steered direction as the US and Iran appear to be far apart, with clear differences on fundamental/basic issues. With current moves based on rhetoric rather than physical action, price action remains contained within recent ranges, for now. Note current support matches the most recent higher low on the chart. Resistance at $70.08 with support at $66.73.

BITCOIN The gentle, but definite daily moves lower continue as buyers remain on the sidelines with limited bounces confirming lack of demand for the cryptocurrency. Noteworthy that since the $10K sell-off (Feb 5th 2025), sellers have not added to the losses. Price action has remained in a tight narrow range, yet the downward bias is reflected in the succession of lower highs and lower lows through the week. Current support level has been tested 4 times since the drop, with buyers protecting the area for now. Resistance at $68.5 with support at $65.8K.

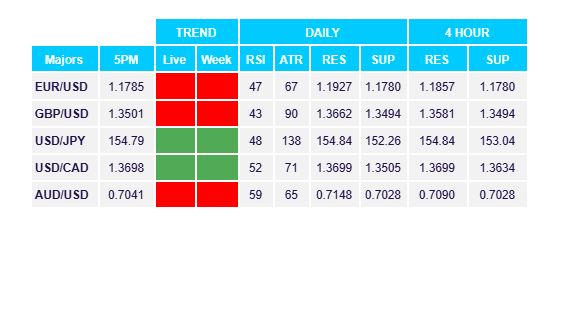

FX Pivot Levels