Market Highlights

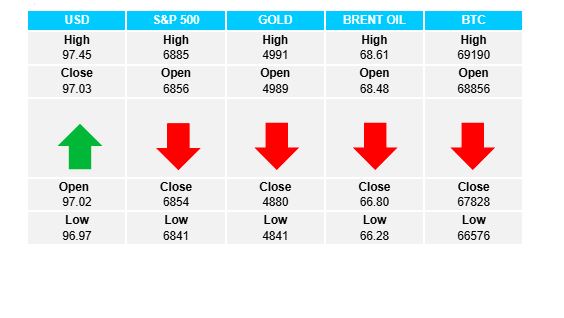

1 - Geneva US/Iran talks: Iran optimism leads to gold and oil sell-off. Gold down 3.02% at $4877; Brent oil down 2.54 % at $66.81

2 - Bitcoin hovers at current lows with little demand, down 0.82% at $67.6K

3 - US equity markets erase early losses to close up on the day. S&P +0.10%, DJ +0.07%, NASDAQ +0.14%

4 - European indices close higher. DAX +0.8%, FTSE +0.79%, IBEX +0.6%

5 - USDX gives up early gains to close unchanged. GBP big loser -0.43%. NZD +0.28% going into RBNZ rate announcement tonight, exp unchanged at 2.25%

Daily Price Activity

Insights

USD INDEX Early demand for USD through the Asian and European sessions was reversed during the US session, which saw the closing price right back at the open. While the daily candlestick has a bearish look with a long upper wick and doji-like feel, the higher high and higher low add to the existing uptrend. Apparently last week’s positive data - NFP and CPI, were not enough to outweigh the negative sentiment surrounding the world’s reserve currency. Resistance at 97.45 with support at 96.97.

S&P 500 In stark contrast to the USDX, early losses (futures market) were reversed as the US session got underway with buyers controlling the day’s activities and reversing the early sell-off. Note today’s close matches the closing price of the past 3 days. Also, the bounce today confirmed the strong support area (6800) which has been guarded by buyers since December 2025. Resistance at 6885 with support at 6790.

GOLD Sellers added to yesterday’s push lower as buyers failed to retake the $5000 mark. Note today’s sell-off was in spite of the USD’s push lower with limited demand for the safe haven commodity. The pattern whereby buyers stepped in at every retracement, seems to be less clear since the sharp drop at the start of the month. Is the metal not a value buy at current prices? Resistance at $4993 with support at $4840.

BRENT OIL Notwithstanding today’s steep sell-off, price activity remains contained within it’s recent well- established range between $66 and $69. Sellers will aim below $66 support in an attempt to extend the downtrend. Note the current support area has acted as both a resistance and support level, which adds relevance to today’s low. Resistance at $68.65 with support at $66.15.

BITCOIN The tight range continued with neither buyers or sellers doing enough to initiate a breakout in either direction. Although the EMAs signal the uptrend remains intact, the bias and sentiment are tilted to the downside as buyers remain unable to bounce up from the strong sell-off which started a month ago (January 15 2026). Resistance at $69.3K with support at $66.5K.

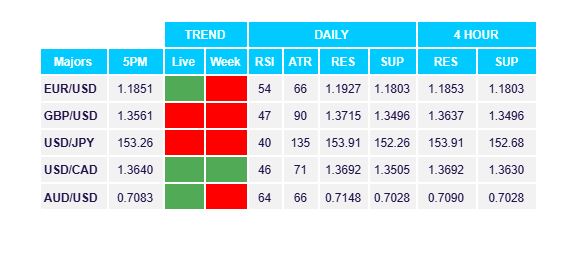

FX Pivot Levels