Market Highlights

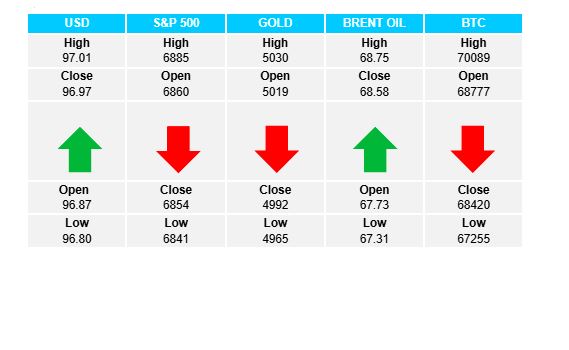

1 - US equity markets closed for Presidents Day. S&P slight gains in futures trading, up 0.1%

2 - Gold down $51 to $4990; Bitcoin down by 0.29% to close $68.5K

3 - Brent oil up 1.40% at $68.52

4 - USD up across the board. JPY +0.49%, EUR -0.13%

5 - European markets close mixed. DAX -0.46%, FTSE +0.25%, IBEX +0.99%

Daily Price Activity

Insights

USD INDEX Presidents Day in the US accounted for limited trading on the futures market with the USD making slight progress as price activity remains contained within it’s narrow recent range. The 97.00 level has looked pivotal as buyers continue to aim above the mark, while sellers have guarded the level successfully. Resistance at 97.01 with support at 96.80.

S&P 500 With equity markets closed, trading was confined to futures with little change from Friday’s close. Notwithstanding, today’s move lower signalled the 5th consecutive red candlestick as the downtrend remains firmly intact. Resistance at 6885 with support at 6840.

GOLD Sellers did just enough to secure the downtrend remains in place with a gentle push lower. The upside target remains at $5100 with sellers looking to extend below the $5000 mark. Resistance at $5036 with support at $4962.

BRENT OIL The $67.20 support area continues to be well guarded as buyers re-assert control. Note buyers can recognize Friday’s low (February 13th 2026) as a new higher low on the chart. With a new series of talks scheduled for tomorrow between US and Iran, it appears that demand is the default direction until any further announcements come out of the meeting. Resistance at $68.76 with support at $67.27.

BITCOIN Sellers won out marginally on the day, with a doji-like candlestick confirming the lack of direction. Note a lower high and lower low on the chart. Trading continues to be contained within a narrow $2.8K range. Buyers aim above the $70K resistance area as a first step to initiating a meaningful breakout to the upside. Resistance at $70.1K with support at $67.3K.

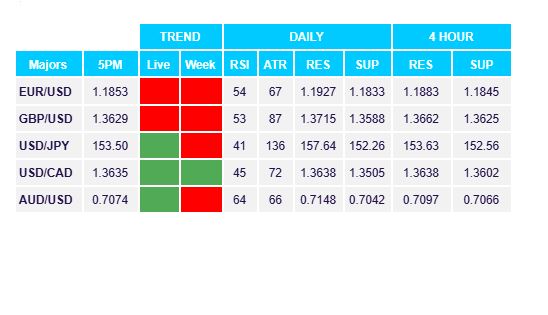

FX Pivot Levels