Market Highlights

1 - Trump: We have to make a deal with Iran; Brent oil down 3.13% at $65.30

2 - Big flight to safety on AI disruption concerns. S&P -1.54%, DJ -1.19%, NASDAQ -2.16%. European markets close lower. FTSE -0.67%, IBEX -0.82%, DAX unchanged

3 - Gold down 3.22% at $4934; Silver down 10.97% at $74.63; Bitcoin moves lower with little demand for the cryptocurrency, down 3.13% at $65.3K

4 - JPY again leading the way against an uncertain USD, -0.29% at $152.79

5 - US CPI tomorrow at 8.30am EST for inflation data - guidance on next Fed rate decision (March 18 2026)

Daily Price Activity

Insights

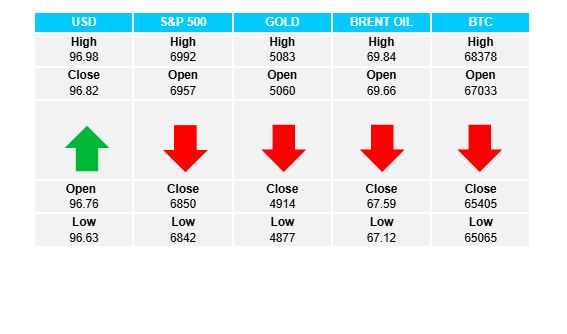

USD INDEX The global reserve currency held it’s ground in a strong sell-off across the major economic markets. A brief test in both directions, only for the index to settle alongside yesterday’s close within it’s recent narrow range. Noteworthy that the USD did not follow the traditional inverse relationship, ie. rally, against a sharp retreat in both the major stock markets and the gold price. Resistance at 97.00 with support at 96.65.

S&P 500 The index was not able to hang on to recent gains as sellers took control with a strong sell-off through the session. The strong 7000 resistance proved it’s resilience, followed by buyers remaining on the sidelines with supply outweighing the lack of demand. Should belated profit-taking and a round of panic set in, sellers will aim at the 6800 mark. Resistance at 6986 with support at 6842.

GOLD The week’s limited gains came to an end as sellers stepped in under the $5100 level, going on to reverse the gentle uptrend with a strong push lower. The trend was reversed with a lower high and lower low to initiate the new downtrend. Buyers will aim to retake the $5000 mark on the upside. Sellers will aim below $4900 in an attempt to add to the downtrend. Resistance at $5091 with support at $4869.

BRENT OIL Trump “confirmed” he will make a deal with Iran. Sellers wiped out the previous 4 day’s gains with a meaningful push lower and in so doing, reversing the trend. Notwithstanding the strong move lower today, price action continues to trade within the recent range between $67 and $70. Note buyers will look up to regain the $68 handle, establishing today’s low as a new higher low on the daily chart. On the flip side, sellers will aim below $67. Resistance at $69.86 with support at $67.12.

BITCOIN A 5th consecutive day of lower highs and lower lows as sellers added to the downtrend. Although the selling was relatively timid in a day where risk assets were sold off sharply (stock markets, gold and oil), the demand for BTC appears to have dried up with little interest in the “bargain price”. While sellers aim for the $60K low, buyers will look up to the $70K level as a minimum to re-establishing interest in the cryptocurrency.

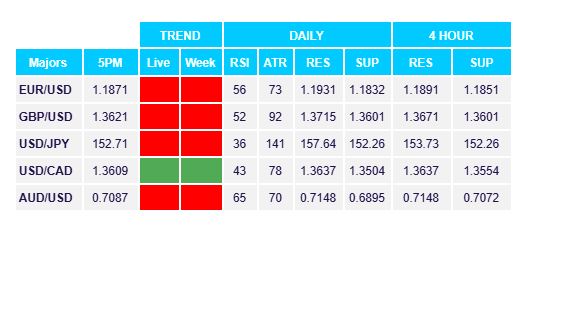

FX Pivot Levels