Market Highlights

1 - US January non farm payrolls +130K vs 70K exp

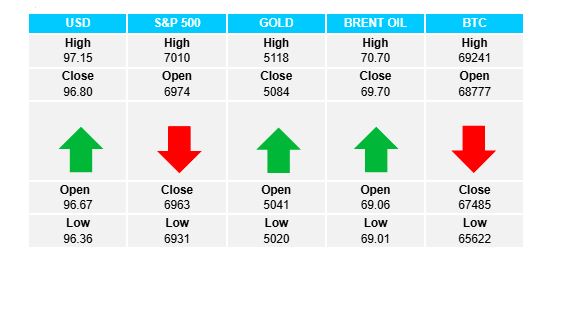

2 - US 10yr yields up 3.3bps to 4.18%; Gold up $63 to $5086; Silver up 3.69% at $84.16

3 - WTI crude up $0.89 to $64.85; Bitcoin down 1.80% at $67.5K

4 - US stock markets relatively flat, S&P +0.05%. European markets close mixed, FTSE +1.1%

5 - USD strengthens following January NFP numbers. JPY leads the way -0.85%, USDX +0.08%

Daily Price Activity

Insights

USD INDEX Although the USD could not hold onto gains following January’s positive jobs report, buyers did enough to close the day higher with a green candlestick putting an end to the 3 day sell-off. With neither side holding on to intraday moves, the trend maintains its downward bias. The 97.00 mark appears pivotal for now with buyers aiming above the mark while sellers look to maintain below the level. Resistance at 97.16 with support at 96.37.

S&P 500 A slight gap higher to start (futures market), a test higher and lower through the session, only for price to close same as yesterday with sellers holding the edge. Note the initial sell-off following the positive jobs report was in keeping with the USD spike higher - inverse relationship between strong dollar and weak equities. For the 3rd consecutive day buyers were unable to maintain above the 7000 mark. Resistance at 7012 with support at 6931.

GOLD A slow steady grind higher saw the metal continue it’s fight back, confirming demand for the safe-haven commodity. While the gain is marginal, the absence of sellers seems more relevant than the price at this point. A higher high and higher low on the chart added to the upward bias. Buyers aim to retest $5100 on the upside. Resistance at $5119 with support at $5024.

BRENT OIL Buyers started strong through the Asian/European sessions, before sellers stepped in to give up more than half of the early gains. Nevertheless, buyers did enough to halt the sell-off and insure a green daily candlestick, and a 4th consecutive higher high and higher low on the chart. As has been the pattern since January 29th 2026, buyers have been unable to maintain above the pivotal $70.00 level. Resistance at $70.22 with support at $69.01.

BITCOIN Despite a late bounce through the US session, sellers won out on the day with a 3rd consecutive red daily candlestick, and a 4th consecutive lower high and lower low on the chart. While the sentiment and bias remain tilted to the downside, buyers will need a break above the $70K level at a minimum to initiate demand for the cryptocurrency. Resistance at $69.3K with support at $65.6K.

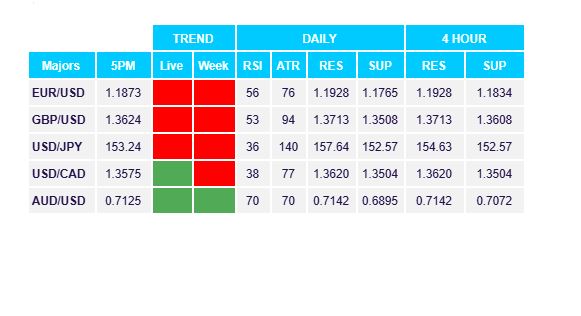

FX Pivot Levels