Market Highlights

1 - US Retail sales disappoint. O.0% vs 0.4% exp. Next up NFP: +70K jobs exp; 4.4 unemployment (unchanged) exp

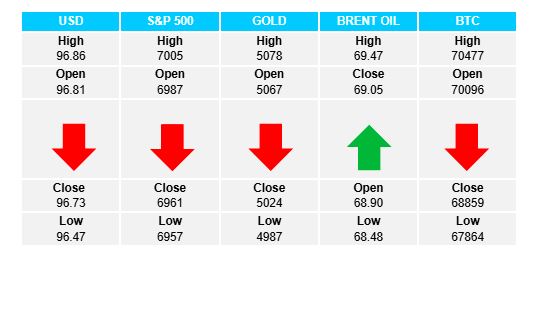

2 - WTI crude down $0.26 to $64.10; Bitcoin unchanged for 4th consecutive day hovering below the $70K area

3 - Gold down $34 to $5030; US 10yr yields down 5.7bps to 4.14%

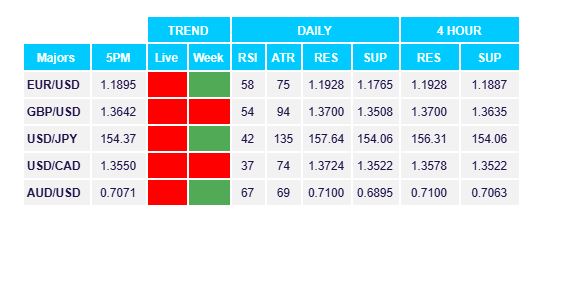

4 - USD lower across the board, with JPY leading the way, -1.05% at 154.37

5 - US stock markets close mostly lower. S&P -0.33%, NASDAQ -0.59%; European markets close strong. DAX +1.15%, IBEX +1.40%

Daily Price Activity

Insights

USD INDEX Following an early sell-off, buyers stepped in through the afternoon portion of the US session, recouped the majority of early losses and went on to end the day alongside yesterday’s close. The downtrend remains intact with a 3rd consecutive lower high and lower low on the chart. Resistance at 96.87 with support at 96.45.

S&P 500 Sellers won out on the day, with a gentle push lower which erased yesterday’s gains. Notwithstanding the red candlestick, the chart confirms a 3rd consecutive higher high and higher low on the chart. The 7000 level was again defended by sellers early in the session. Resistance at 7007 with support at 6953.

GOLD A relatively narrow $100 range saw sellers doing enough to secure a lower close and red daily candlestick. Aside from the small loss on the day, a higher low on the daily chart (although slight) may tilt the bias slightly to the upside. Buyers continue to aim at the $5100 mark on the upside, while sellers look to maintain below the $5000 level. Resistance at $5081 with support at $4981.

BRENT OIL Buyers did just enough to recoup a slight gap lower at the open, doing enough to secure a green daily candlestick, ending the day alongside yesterday’s close. The overall trend remains up since the start of the year with a series of higher lows following dips/retracements up to this point. Resistance at $69.26 with support at $68.44.

BITCOIN Sideways activity within a narrow $2.5 - $3K range continued for the 4th consecutive day. Sellers won out for the day, continuing to add to an overall bearish feel. Buyers were held up at the $70.5K resistance for the 4th consecutive day. To date, buyers have been unable to regain the losses from last week’s sharp one day sell-off ($73K down to $62K). Resistance at $70.5K with support at $67.8K.

FX Pivot Levels