Market Highlights

1 - US stock markets close up on the day. S&P +0.54%, DJ +0.1.05%, NASDAQ +0.56%. European markets broadly rally. DAX +1.05%, FTSE +1.15%, IBEX +1.3%

2 - Bitcoin bounces slightly, +1.41% at $78.3K; Brent oil down 4.30% at $66.34

3 - Gold stabilizes after sell-off continues, -1.22% at $4683

4 - USD gains across the board. USDX +0.49%; JPY +0.22% at 155.54, CAD +0.31% at 1.3702

5 - January Non Farm Payrolls delayed, no report on Friday as per schedule; Trump: “I’m reducing tariffs on India to 18% from 25%”

Daily Price Activity

Insights

USD INDEX USD started this week on the front foot, picking up from last week’s bounce with a higher high and higher low, enough to signal a new uptrend on the charts. Note the resistance now matches the support area from December 2025. Resistance at 97.59 with support at 96.88.

S&P 500 Buyers wiped out early losses from the futures market and went on to confirm demand for US equities with a solid start to the month. Price action maintained above the ascending trendline. Note US stock markets moved in the same direction as the USD, (higher) rather than the traditional inverse relationship between the 2 asset classes. Buyers will aim to maintain above the 7000 level. Resistance at 7019 with support at 6862.

GOLD A 3rd consecutive volatile day as the metal continues to see sharp swings within an unusually wide $500 trading range. A gap lower to open the new week, followed by a move lower through the Asian session, a recovery through the European session, and then a bearish feel throughout the US session as buyers struggled to hold on to intraday moves to the upside. Note the low of the day matches the resistance level from October 2025. Trend (EMAs) and bias clearly point to the downside. Buyers will aim to test the $5000 mark in order to reverse the new downtrend. The sell-off appears to be purely technical in nature - overbought technicals, coupled with profit-taking - as the fundamentals which created demand for the safe-haven commodity remain unchanged. Resistance at $4895 with support at $4389.

BRENT OIL The new month opened with a sharp gap lower at the open, a bout of selling as the Asian session opened, before buyers stepped in as the European session got underway. Buyers and sellers traded punches through the US session, going on to settle at $66.39, the middle of today’s $2 trading range. Resistance at $67.36 with support at $65.43.

BITCOIN Buyers stepped in today and did enough to pause the downtrend which has been in place since January 15 2025. The green daily candlestick confirms the higher close, yet does little to change the picture - unable to take out yesterday’s high, and a new low matching that from March 2025. Buyers will aim above the $80K level as a minimum to reverse the current mood and attempt to initiate new demand. Resistance at $79.3 with support at $74.4K.

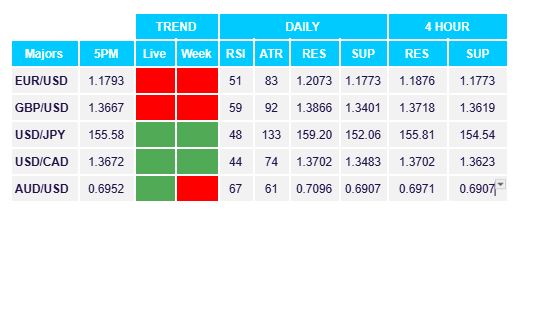

FX Pivot Levels