Market Highlights

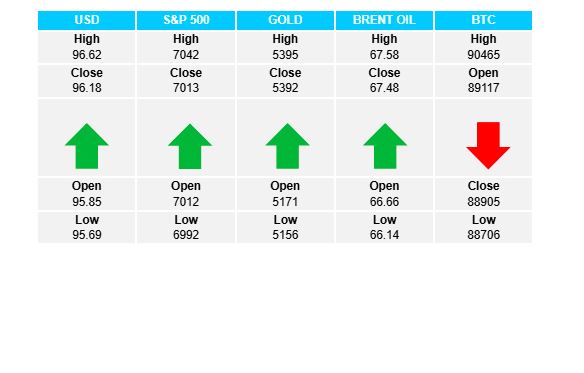

1 - US stock markets close slightly up on the day. S&P +0.01%, DJ +0.02%, NASDAQ +0.17%. European markets close lower. DAX -0.29%, FTSE -0.52%, IBEX -1.10%

2 - Massive day for gold, up $296 at $5377; Silver up $10.37 at $116.23

3 - Bitcoin flat at $88.9K, Brent up $0.98 at $68.52

4 - USD recovers with small gains; USDX +0.60%; EUR -0.53%, GBP -0.12%

5 - Fed holds rates, as expected. Powell: “US economy entering 2026 on solid footing” adding “the economy has surprised us with its strength”

Daily Price Activity

Insights

USD INDEX While the index remains in a strong downtrend, the charts reflect a bounce up today as buyers added to the gap higher at the open, going on to recoup a portion of yesterday’s steep losses. Unable to hang onto the gains (following FOMC meeting) sellers had the final say going into the close - see wick on daily candlestick. Technicals confirm the downtrend is still firmly intact, with oversold technicals remaining in oversold territory (RSI 31). Interestingly, Fed chairman Powell stated the US economy is on solid ground going into the new year. However, the data does not reflect the negative sentiment surrounding the dollar. Resistance at $96.61 with support at 95.69.

S&P 500 The index closed relatively unchanged from the open with the doji-like candlestick confirming the indecision. Despite a brief record high early, neither side was ale to hold onto intraday moves. Buyers will aim to maintain above the 7000 mark, while sellers look below that pivotal level. Note the succession of higher lows on the daily chart. Resistance at 7042 with support at 6989.

GOLD Buyers were unrelenting as demand for the metal saw record gains, and unsurprisingly, a new all-time high for the 7th consecutive day. Sellers show no interest in profit-taking or overbought technicals (RSI 90) with no barriers on the upside. Today’s rally was in spite of the USD strengthening and no news on the fundamental front. From a trading perspective, limited pullbacks/retracements continue to be seen as new trading opportunities. Daily Resistance at $5401 with 4 hour support at $5234.

BRENT OIL Buyers added to yesterday’s gains with another strong day confirming demand for the commodity. The uptrend reflects a 4th consecutive day of higher highs with the $70 level next on the upside. Uncertainty surrounding unsettled geopolitical conflicts adding to the technical picture. Resistance at $67.64 with support at $66.14.

BITCOIN A 3rd consecutive higher high on the chart, EMAs almost crossing to the upside, and a very shallow green candlestick all confirming the slight gains - however, the chart looks less than bullish. Once again buyers could not break above the $90K resistance area as demand for the cryptocurrency remains limited. From a sentiment perspective there appears to be a lack of confidence with buyers unable to recover from the steep sell-off late last year. While $90K continues to cap the upside, sellers aim to test below $88K to reinstate the downtrend. Resistance at $90.5K with support at $88.8K.

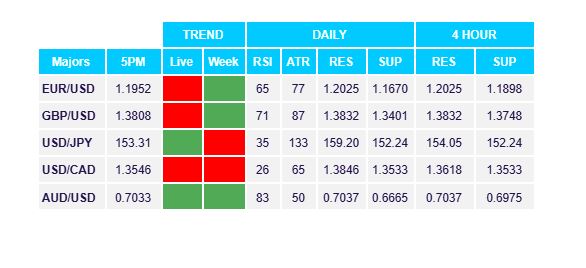

FX Pivot Levels