Market Highlights

1 - US stock markets continue to grind higher, closing up on the day. S&P +0.50%, DJ +0.64%, NASDAQ +0.43%. European equities close mixed; DAX +0.13%, FTSE +0.05%, IBEX +0.78%

2 - Gold and silver soar to record highs. Gold up 1.23% at $5046, Silver up 6.14% at $106.35

3 - Bitcoin struggles with a modest gain. Up 1.34% at $87.5K

4 - US yields lower across the board. USD sell-off continues into the new week. USDX -0.41%, EUR +0.17%, GBP +0.11%, JPY -0.66%; CAD the sole exception as Trump threaten 100% tariffs, +0.07%

5 - Trump sends armada to Iran region saying “the situation is in flux”; Crude oil up slightly +0.38% at $60.82

Daily Price Activity

Insights

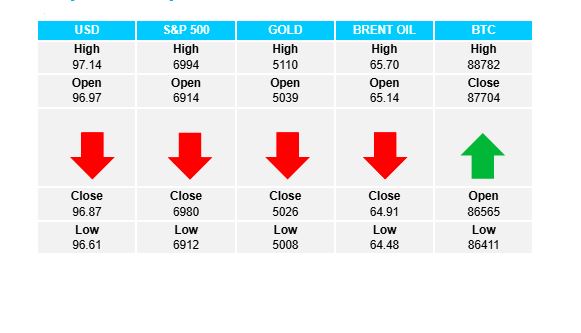

USD INDEX Dollar weakness continued into the new week with sellers maintaining control. Support held up today with buyers guarding the support area with a technical bounce on the first attempt to break the level. A reversal will require buyers to confirm demand for the global reserve currency. At this point negative sentiment surrounding the USD weighs on the supply side. Resistance at 97.14 with support at 96.60.

S&P 500 Demand for US equities across the board with buyers confirming an uptrend on the index. The rally was in keeping with the traditional inverse relationship against a weak USD. Next upside target is the 7000 level. Note buyers were unable to maintain above that mark earlier this month (January 9 2025). Resistance at 6996 with support at 6911.

GOLD A gap higher to start the week, followed by yet another new record high for the metal. Buyers were unable to maintain through the late US session where sellers did enough to secure a lower close on the day. Notwithstanding the red candlestick, a higher high and higher low confirm the uptrend which has been in place since the start of the year. Sellers will aim below $5000 where a new push lower could invite a round of profit taking. Resistance at $5109 with support at $4999.

BRENT OIL Neither buyers nor sellers could hold onto intraday moves. The gap lower to start the trading week was enough to secure a red candlestick for the day, although the uptrend remains intact. Geopolitical uncertainty keeps the market on edge, with fundamentals relying on rhetoric at this point, rather than physical action. Note the descending trendline which has contained the upside thus far. Potential moves favour a break to the upside should supply concerns come into the picture. Resistance at $65.72 with support at $64.46.

BITCOIN As has been the case since late last year, buyers have defended the current support with a higher close on the day. Nevertheless, today’s green candlestick and higher close have not had an effect on the strong downtrend. Note the 3rd consecutive lower high on the charts. Trend, sentiment and fundamentals (BTCs inability to attract interest as a safe-haven currency) all contribute to the current bearish feel. Sellers will continue to aim below the stubborn $86K support while buyers look above $90K in an attempt to reverse the trend. Resistance at $88.7K with support at $86.4K.

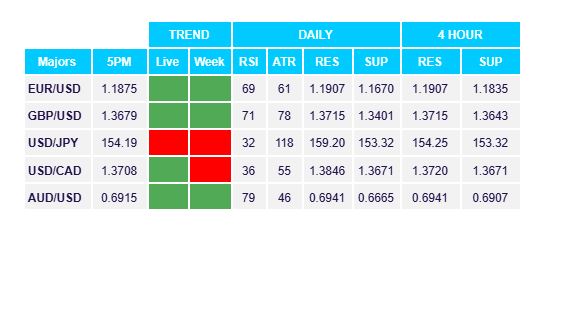

FX Pivot Levels