Market Highlights

1 - Trump cancels Greenland tariffs. US equity markets rally.S&P +1.16%, DJ +1.21%, NASDAQ +1.18%

2 - European markets rally. DAX +1.04%, FTSE +1.06%, IBEX +0.39%

3 - Gold up $18 to $4780; Crude oil up $0.27 to $60.63

4 - Bitcoin up 1.19% at $89.4K

5 - USD rallies late; USDX +0.24%, EUR-0.34%, GBP -0.08%, JPY +0.08%

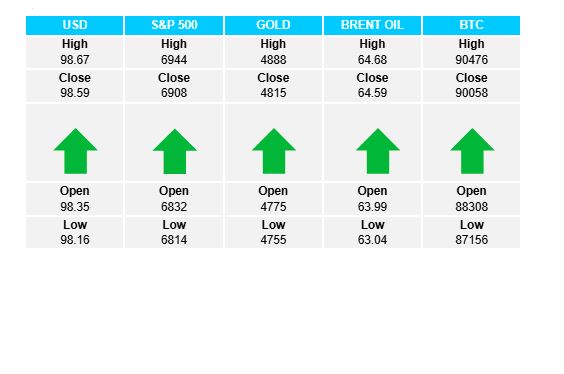

Daily Price Activity

Insights

USD INDEX A nervous start to the day which ended with the USD strengthening, and in so doing, erasing more than half of the losses incurred yesterday. The trend remains down with a lower high on the charts. From a sentiment perspective, Trump walking back on “ownership of Greenland by force”, to “control for an unlimited time” was the contributing factor. Resistance at 98.66 with support at 98.16.

S&P 500 A late rally saw buyers erase yesterday’s losses as the index went on to regain the 6900 level. Clearly the market responded to Trump’s new rhetoric claiming the US would not use force to own Greenland, and equally significant for the equity markets, the proposed tariff threats were also cancelled. With many questions remaining unanswered, taking these 2 threats off the table was enough for the markets today. Continued optimism will see buyers aim to retake the 7000 mark. Resistance at 6946 with support at 6816.

GOLD The 3rd successive day seeing new record highs for the metal. Following an early rally, post Devos statements at the World Economic Forum saw sellers’ step in and give up a portion of the early gains. This volatility is a clear reflection of the commodity’s safe haven status being heightened with uncertainty surrounding geopolitical situations (Greenland), and cooling off when a resolution/answer to the situation is declared. Resistance at $4893 with support at $4753.

BRENT OIL A gentle push higher was enough to signal an uptrend on the charts. However, with no significant fundamentals contributing to supply/demand for the commodity, prices remained within the relatively narrow sideways range between $63 and $65. Notwithstanding the green candlestick and uptrend, note the contradictory lower high and lower low on the daily chart. Resistance at $64.75 with support at $63.06.

BITCOIN As has been the case since December 2025, buyers stepped in at the $87K support, going on to recoup roughly half of yesterday’s losses. Although today’s bounce is reflected as a green daily candlestick, the downtrend remains intact with a lower high and lower low on the chart. Buyers aim to break above $90K on the way to $92K as a first step to reversing the downtrend. Resistance at $90.4K with support at $86.9K.

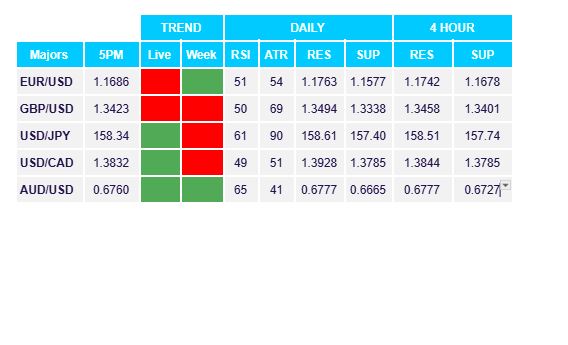

FX Pivot Levels