Market Highlights

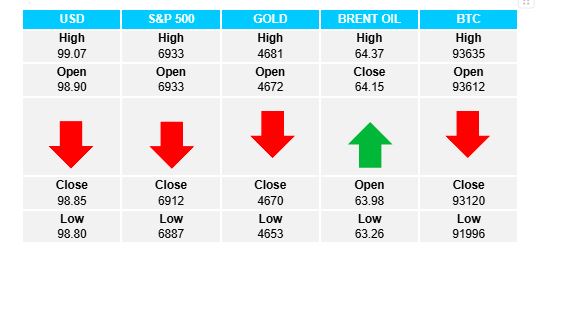

1 - US stock markets closed, yet all lower in futures trading: S&P -1.1%, DJ -0.8%, NASDAQ -1.4%

2 - European equity markets closed lower on the day. DAX -1.2%, FTSE -0.4%, IBEX -0.2%

3 - Gold sets new all-time high at $4682; Silver not to be outdone, sets new record high at $94.39

4 - Brent oil makes slight gains, up 0.27% at $64.14; Bitcoin down 0.65% at $93K

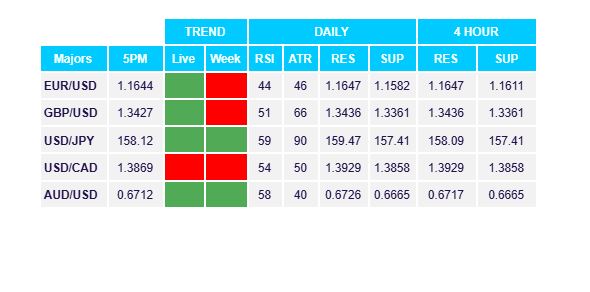

5 - USD loses across the board, with JPY the exception. USDX -0.34%, EUR +0.18%, GBP +0.19%, CAD -0.22%, JPY +0.36%

Daily Price Activity

Insights

USD INDEX A gap lower to start the week saw the index open below the 99.00 level and the EMAs taking a sharp turn lower. A rather inactive Asian and European session, followed by a holiday in the US (Martin Luther King day), saw prices push slightly lower, yet remain close to the open without buyers stepping in to recoup the early losses. Note the support matches the lows from mid November 2025. Resistance at 99.08 with support at 98.79.

S&P 500 Stock markets were closed in the US today. There was a gap lower in futures trading, followed by a small move lower where prices settled for the day. The push down was enough to confirm the downtrend and move the price further below the 7000 level. Resistance at 6935 with support at 6890.

GOLD The early gap up to start the day was enough to set yet another new all-time record high for the metal. Today’s lack of any significant activity left the price back where it started. The doji-like candlestick confirmed the lack of direction. Resistance at $4682 with support at $4651.

BRENT OIL As was the pattern across financial markets today, the inactivity saw oil prices basically unchanged, closing slightly up on the day. With the World Economic Summit underway in Davos Switzerland, no doubt there will be rhetoric which may well affect commodity prices in the coming days. Resistance at $64.36 with support at $63.26.

BITCOIN The early sell-off was short lived as buyers brought prices back to where they started with no change to the newly established downtrend. Buyers will continue to look above $94K while sellers aim below $92K. Resistance at $93.7K with support at $91.9K

FX Pivot Levels