Market Highlights

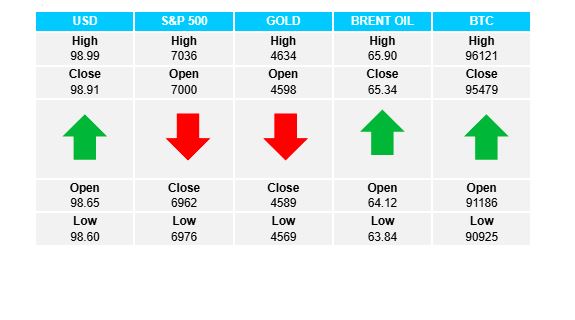

1 - US stock markets close lower on the day. S&P -0.31%, DJ -0.86%, NASDAQ -0.17%

2 - Gold takes a breather, -$2.11 at $5493; Silver no letting up, +$1.59 at $86.58

3 - Demand for oil continues amid Iran uncertainty. Crude up $1.59 at $60.99

4 - Bitcoin breaks out of sideways range. Up $5K at $96K

5 - Fed’s Barkin: “inflation easing gradually and labour risks contained” - supports expectation of Fed pause

Daily Price Activity

Insights

USD INDEX The USD continued its strong rally which has been in place since the start of the year. The strength of the global reserve currency is backed by technical and fundamental influences, although it does feel that sentiment may not measure as positively. Note the current resistance has held 3 times since December 2025. Resistance at 99.00 with support at 98.59.

S&P 500 Today’s session had 3 distinct parts: a new record high set in the European session, followed by a steep sell-off early in the US session, only for buyers to put in a late rally into the close. Bottom line resulted in a slight loss on the day, although the year long uptrend remains intact. Significantly the late push higher did reach the 7000 level. Resistance at 7036 with support at 6975.

GOLD Buyers took the day off early as the rally to start the year paused after reaching yesterday’s record high, and then retracing slightly to close alongside yesterday’s close price. While sellers won out on the day with a lower close, thereby reflected in a red daily candlestick, practically nothing changes from a technical or fundamental perspective. Resistance at $4635 with support at $4570.

BRENT OIL A 5th consecutive day of higher highs and higher lows as demand continues for oil with the Iran conflict creating uncertainty surrounding supply concerns. Buyers broke above the $65 level with ease, as the $66 mark (October 8 2025) shapes up as next target on the upside. Barring a fundamental change to the current situation, sellers remain on the sidelines for now. Resistance at $65.94 with support at $63.84

BITCOIN A strong showing saw buyers break out of the 5 day sideways range, going on to add $5K+, breaking the high from early in the year (Jan 5th 2026). Buyers will recognize a mild, but steady series of higher lows following dips since the November 21st low ($80.5K). Resistance at $96.1K with support at $90.8K.

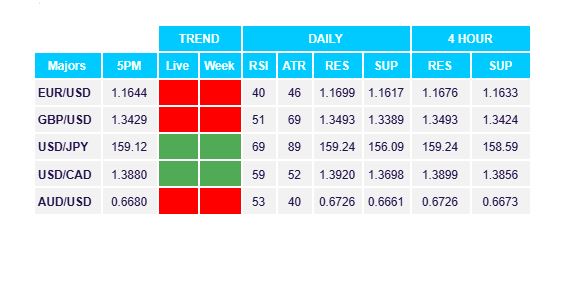

FX Pivot Levels