Market Highlights

1 - Gold down $45 to $4453; Silver down $2.80 to $78.07; Goldman Sachs sees extreme volatility in silver prices to continue

2 - WTI Crude down 1.44% to $56.29; Bitcoin down 1.59% at $91K

3 - S&P sets record high before closing lower on the day; S&P -0.34%, NASDAQ -0.16%, DJ -0.94%

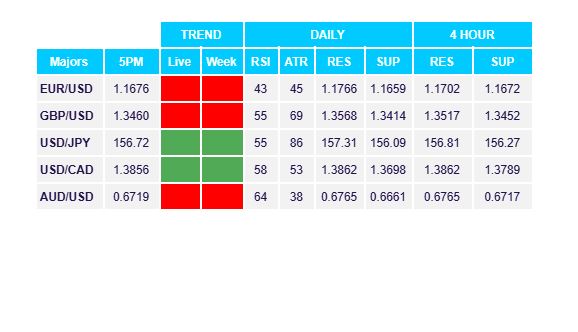

4 - USD strengthens across the board. USDX +0.17%, EUR -0.10%, GBP -0.31%, JPY +0.04%, CAD +0.31%

5 - US 10yr yields down 3bps to 4.15%

Daily Price Activity

Insights

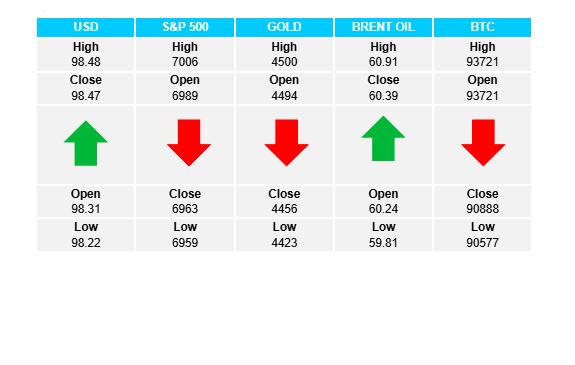

USD INDEX Another strong day for the USD saw the index add to the existing uptrend with a higher high and higher low on the chart. Sellers did not step on with the candlestick close matching the high - a bullish signal. Buyers will be eyeing the next resistance at 98.96 (December 9 2025). Sellers will aim to retest the 98.00 mark (recent comfort area) on the downside. Resistance at 98.48 with support at 98.21.

S&P 500 Buyers opened with a push up, eventually breaking above the 7000 mark and setting a new record high for the index. Sellers stepped in late in the US session and went on to close lower on the day. Notwithstanding, the candle reflects the 4th consecutive higher high and higher low on the chart. Resistance at 7008 with support at 6960.

GOLD Sellers set the tone early with a strong sell-off, reversing yesterday’s gains. Buyers did step in through the US session, recouped a portion of the losses, going on to close alongside yesterday’s open price. The $4500 mark could be a pivotal level going forward. The trend remains up with fundamentals and technicals both favouring the upside. Resistance at $4501 with support at $4419.

BRENT OIL An early sell-off saw a break below the $60 level, before buyers stepped up late in the US session to recoup losses, and go on to close slightly above the open. Price activity/range is trading a leg lower than we saw last week. Buyers will aim above $61 on the way to testing the descending trendline and reversing the trend. Interesting that the US attack of Venezuela and the ensuing question of oil ownership, has not had an effect on supply concerns (as yet) - prices are currently lower than last week. Resistance at $60.96 with support at $59.79.

BITCOIN Sellers won out on the day, yet the trend moves sideways as the cryptocurrency traded within the same $3K range ($91K - $94K) for the 3rd consecutive day. Buyers have tried to break above current resistance several times since December 2025, without success. While the trend remains up on the daily chart, the fact that buyers did not step in (as they did yesterday) may tilt the bias downward. Resistance at $93.7K with support at $90.6K.

FX Pivot Levels