Market Highlights

1 - Morgan Stanley forecasts gold at $4800 byQ4 2026; up $52 today at $4494; Silver up 6% at $80.64

2 - WTI Crude down $1.35 at $56.97

3 - US stock markets close higher on the day with DJ leading the way; S&P +0.62%, NASDAQ +0.65%, DJ +0.99%; AMZN flat in 2025, up 4.3% this year

4 - AUD/USD hit fresh one year high +0.41%; USDX +0.30%, EUR -0.22%

5 - US 10yr yields up 1bps to 4.17%

Daily Price Activity

Insights

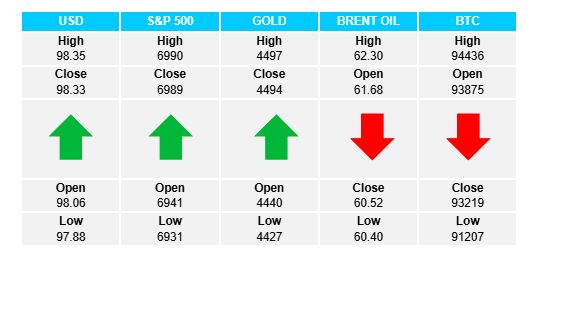

USD INDEX Buyers stepped in today, recouped yesterday’s losses and maintained the uptrend which has been in place since December 26 2025. Today’s higher close marks the 8th green candlestick over the past 9 trading days. The current resistance area has been well guarded by sellers, with the 98.00 mark continuing to be seen as a pivotal level for now. Resistance at 98.35 with support at 97.87.

S&P 500 Buyers picked up from where they left off yesterday, confirming demand for US equities with the index going on to start the year with a record high. Note the US stock markets and the USD moved in the same direction (higher) today. Next target on the upside remains the 7000 level. As the index enters unchartered territory, the lack of previous resistance levels could make for sharp moves to the upside. Resistance at 6989 with support at 6932.

GOLD The metal continues to move higher as buyers confirm demand for the safe-haven commodity. As long as profit taking and overbought technical influences remain sidelined for now, the record high $4549 (December 26 2025) is clearly the next upside target. Resistance at $4494 with support at $4427.

BRENT OIL Following a brief, early push higher, sellers stepped in and wiped out yesterday’s gains. The activity remained within the narrow range $2 range ($60.50 - $62.50) which has contained prices since December 23 2025. Note today’s push lower brought price activity back below the descending trendline which was tested yesterday. Current support level has been well defended as sellers aim to retest the solid floor. Resistance at $62.30 with support at $60.40.

BITCOIN A red candlestick confirms sellers won out on the day. However, with resistance and support levels matching that of yesterday, the uptrend remains intact, and possibly sideways best describes the activity. Buyers put in a late rally on the way to recouping the majority of earlier losses, perhaps tilting the bias upwards. Buyers will once again aim above the $94K level, while sellers look down at the $90K mark.

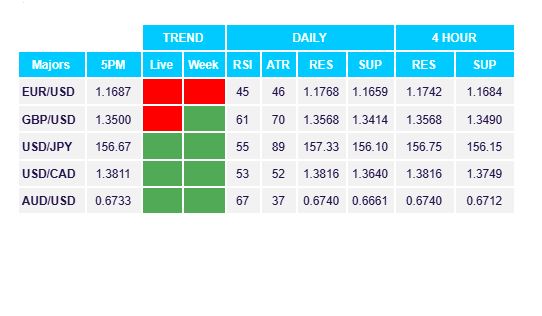

FX Pivot Levels