Market Highlights

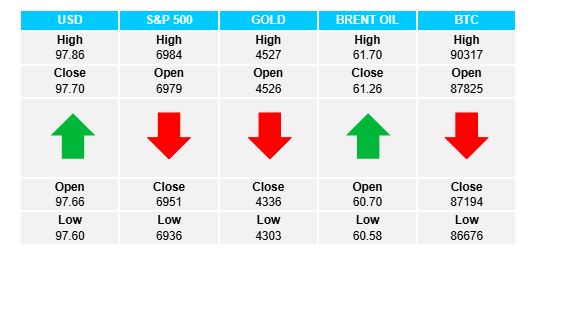

1 - US stock markets close lower. S&P -0.32%, DJ -0.39%, NASDAQ -0.49%

2 - US yields down. 2yr -3.46%, 10yr -4.11%, 30yr -4.79%

3 - Brent oil up $1.00 to $61.70; Bitcoin down $700 to $86.6K

4 - Metals sold off sharply. Gold loses $230 at $4340; Silver down $11.00 at $72.30

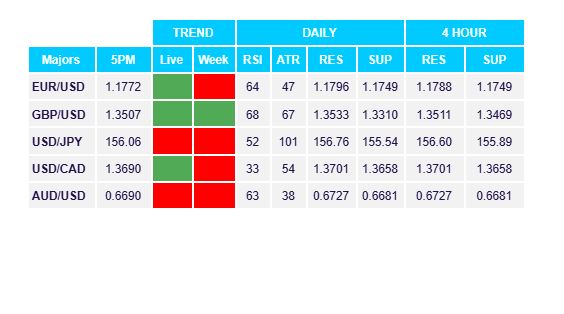

5 - USD closes higher across the board. USDX +0.06%, EUR unchanged, GBP +0.12%, JPY +0.15%, CAD +0.12%

Daily Price Activity

Insights

USD INDEX Technically buyers held on to early gains signalling a higher close on the chart. Practically, it was a case of same old…with a daily close matching that of the past 4 days within a sideways trend and flat EMAs. Note the descending trendline was tested, with price activity being contained, tilting the bias to the downside. Resistance at 87.86 with support at 97.60.

S&P 500 Buyers unable to maintain last week’s record high levels as sellers stepped in and retraced a portion of last week’s gains. The sell-off was limited and appears to be more a case of profit taking as the year draws to a close, rather than a meaningful reversal. Resistance at 6984 with support at 6935.

GOLD Sellers took control from the outset and put in a strong push lower (-$200), erasing last week’s gains and doing enough to signal a reversal on the charts. The sell-off was not unexpected from a technical perspective as overbought conditions coincided with a bout of profit-taking as the year draws to a close. The next session may well provide buyers with new opportunities at the lower levels, as clearly the metal has not lost its safe-haven status. On the flip side, sellers may continue with the profit taking strategy in anticipation of a further drop. Note the double top candlestick formation, a strong reversal sign. Resistance at $4530 with support at $4299.

BRENT OIL Buyers added to the gap up to start the day and held onto gains for a modest push higher. Price activity maintains below the descending trendline with neither buyers or sellers doing enough to break out of the sideways range between $60 and $62. Resistance at $61.71 with support at $60.58.

BITCOIN The sideways pattern continues with yet another close matching that of the past 2 weeks. Price activity remains contained within a narrow $4K range between $86K on the downside and $90K on the upside. With little in terms of technicals, the lack of demand for BTC, and inability to fight back from the $46K drop through October and November ($126K down to $80K), bias and sentiment seem tilted to the downside. Note the descending trendline which has held attempted rallies to break above the $90K mark over the past week. Resistance at $90.3K with support at $86.6K.

FX Pivot Levels