Market Highlights

1 - US stock markets close higher on the day. S&P +0.46%, DJ +0.16%, NASDAQ +0.57%; tech shines, healthcare falters

2 - Metals extend strength.Gold up $40 at $4499; Silver up $2.40 at $71.45

3 - US yields mixed. 2yr +3.53%, 10yr -4.16%

4 - USD weakens across the board. USDX -0.34%, EUR +0.25%, GBP +0.37%, JPY -0.49%, CAD -0.43%

5 - Brent oil extends gains, up 0.80% ($0.50) at $61.94; Bitcoin down 1.45% at $87.2K

Daily Price Activity

Insights

USD INDEX Sellers extended yesterday’s sell-off with another push lower, and in so doing initiated a new downtrend on the charts (EMAs crossed down). US December consumer confidence report contributed - 89.1 v 90.1 expected. Today’s low matches that from December 16 2025. Resistance at 97.87 with support at 97.50.

S&P 500 The “santa rally” continues to give with the index trading at record highs going into Christmas eve. A 4th consecutive higher high and higher low on the charts adding to the uptrend. The upside target of 7000 before year-end? Profit taking has not yet entered the picture as sellers remain on the sidelines. Resistance at $6965 with support at 6921.

GOLD The familiar 2025 pattern continues… another day and a new record high for the safe haven commodity. Adding $40 to yesterday’s record high and as yet, no sign of profit taking and apparent disregard for the overbought technical reading (RSI 80!). Resistance at $4499 with support at $4430.

BRENT OIL Buyers continued with the impressive fight back for the 3rd consecutive day. While the overall trend maintains a downward bias, the current trend has crossed to the upside (EMAs up). What started as a technical bounce now appears to have fundamental support with geopolitical conflicts (middle east, Russia/Ukraine, Venezuela) adding to potential supply concerns. Note the descending trendline which coincides with the $64 area. Resistance at $62.05 with support at $61.32.

BITCOIN Following yesterday’s failed attempt on the upside, sellers won out today taking out the lows from the past 4 days. Trend, bias (and possibly sentiment as well) all tilted to the downside going into Christmas eve. To date BTC has never recovered from the 2 month sell-off through October and November which saw the cryptocurrency dive from a $126K high (October 6 2025) down to $80.4K (November 21 2025). Currently the $85K - $87K area appears to be a comfort zone as the sideways activity continues. Resistance at $88.9K with support at $86.6K.

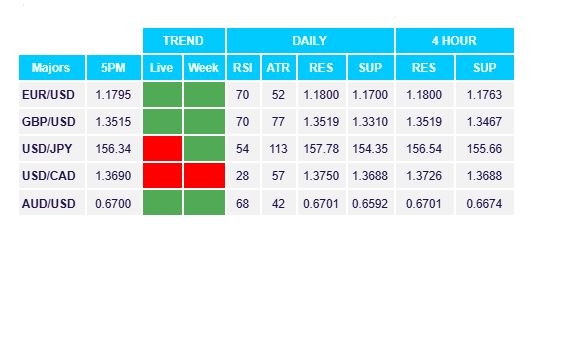

FX Pivot Levels