Market Highlights

1 - ECB leaves rates unchanged, but lists 2026 inflation forecast; BOE delivers 0.25% cut as expected

2 - US 10yr yields down 3.3 bps

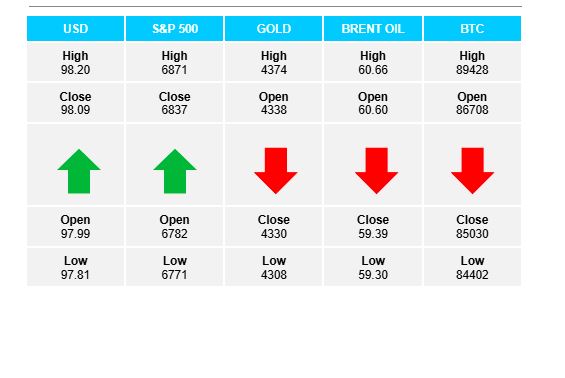

3 - Gold down $10 to $4330; Bitcoin down 1.33% at $85.1K

4 - EUR lags, AUD leads; GBP battles after “hawkish cut”

5 - Soft CPI ignites relief rally in major US stock markets. DJ +0.14%, S&P +0.79%, NASDAQ +1.38%. European markets: Ibex +1.15%, DAX +1.0%

Daily Price Activity

Insights

USD INDEX Buyers added to yesterday’s gains with a gentle push higher, enough to signal the start of a new uptrend as the EMAs crossed to the upside. Buyers will aim to maintain above the 98.00 level confirming demand for the world’s global currency, notwithstanding the recent rate cut and disappointing job numbers. Resistance at 98.20 with support at 97.81.

S&P 500 A strong day for US stock markets with the index recouping yesterday’s losses. Although today’s bounce put an end to the strong 4 day sell-off, the downtrend still remains intact. It appears the 2 opposing camps have profit-takers on the one side, while the traditional Christmas/end year rally is keeping buyers interested on the other hand. Resistance at 6871 with support at 6773.

GOLD Buyers touched on the October record highs, before sellers stepped in and closed back where the day started. A doji-like candlestick confirming the indecision. However, note that the activity remains within a bullish environment with a higher high and higher low on the chart. Note the sharp ascending trendline. While the technicals and sentiment remain positive, perhaps a new record high before the year is out? Resistance at $4374 and support at $4308.

BRENT OIL The one-day bounce was cancelled out today as sellers stepped in from the outset and went on to erase yesterday’s gains. The downtrend gained momentum as buyers remained on the sidelines. It does seem that the bounce was technically inspired, as demand for the commodity continues to be outweighed by the supply side. Sellers will aim below $59 while buyers look up to regain the $60 mark at a minimum. Resistance at $60.72 with support at $59.25.

BITCOIN Sellers maintained control and went on to record the lowest close since October 21st 2025. Bias, trend and sentiment all point down. Note the descending trendline held strong. The broad $5K range between $85K and $90K continues to hold. Should sellers break and maintain below current support, the next downside target sits at $80K. Resistance at $89.4 K with support at $84.2K.

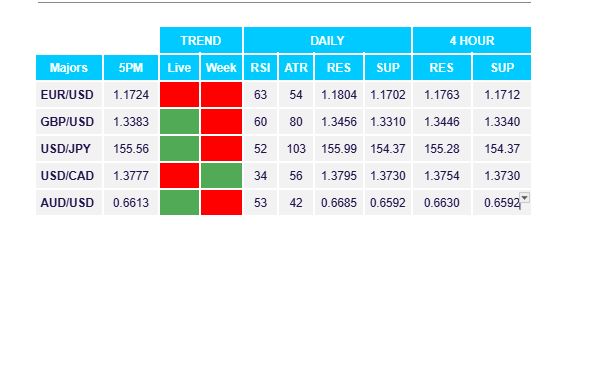

FX Pivot Levels