Market Highlights

1 - Stock markets down led by tech/AI/chips; DJ -0.51%, S&P -1.15%, NASDAQ -1.78%

2 - Silver standout performer up $2.70 at $66.44; Gold up $42 at $4345

3 - Oil up $1.58 at $56.85; WTI crude is down 23% year to date

4 - US/JPY biggest gainer today +0.65% - BOJ decision Friday; GBP/USD lost 0.34%; US/CAD rose 0.21%

5 - Data releases: BOE expected to cut rates from 4.00% to 3.75%; EU expected to hold at 2.15%; US: Unemployment claims

Daily Price Activity

Insights

USD INDEX The dollar index had a strong start, bouncing up off support and taking out highs from the 3 previous days. Buyers did not hold on, with sellers stepping in thereby losing roughly half of the early gains. Once again the support level held strong with today’s move enough to signal a reversal on the shorter time frame (4hr). Resistance at 98.27 with support at 97.81.

S&P 500 Sellers added a 4th consecutive lower high and lower low to the strong downtrend. Today’s push lower took out significant lows going back to November 26th 2025. Next target on the downside sits at 6700. After a year long bull market with the index setting a string of record highs, a year-end bout of profit taking is not to be unexpected. Resistance at 6883 with support at 6773.

GOLD A slow steady push higher confirming demand for the safe haven commodity. Although the metal continues to trade within it’s recent range, prices closed at resistance levels with buyers looking at the October record highs ($4381). Note gold and the USD moved in the same direction (higher) as opposed to the traditional inverse relationship between the 2 major assets. Resistance at $4349 with support at $4307.

BRENT OIL A gap higher to start the day was followed up with buyers putting in a strong showing, erasing yesterday’s losses and going on to take out yesterdays high. Note today’s high matches the strong support from October 2025. Also, this is the 3rd time this year that buyers guarded the $59/$60 support area. The upside target sits at $61 while sellers look below $60 in an attempt to resume the sell-off which started on December 8 2025. Resistance at $60.72 with support at $59.25.

BITCOIN Sellers put a quick end to yesterday’s brief rally, erasing the gains, adding to the downtrend and once again testing the solid support area. This bout of selling is the 3rd attempt to break below the $85 -86K level since November 21st 2025. Resistance at $90.5K with support at $85K.

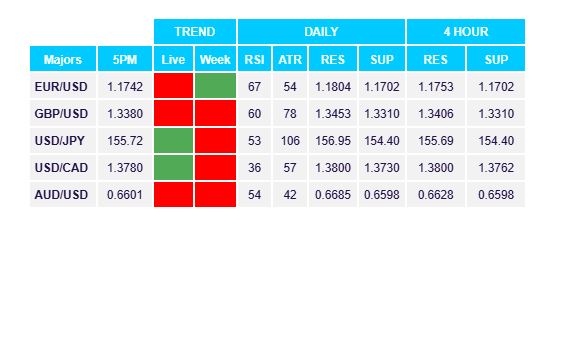

FX Pivot Levels