Market Highlights

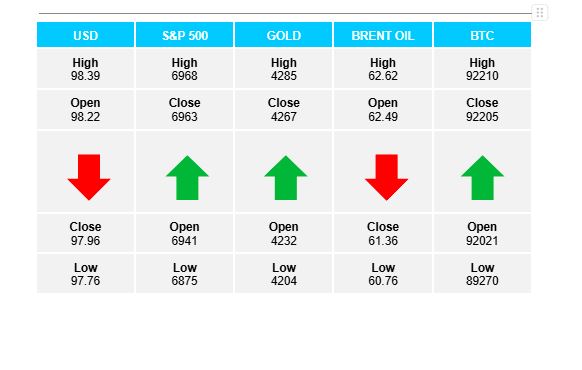

1 - Major stock indices end mixed as DJ and S&P reach new records; NASDAQ falls on tech weakness

2 - Silver races to record high over $64; Gold up $45 chasing $4300; Oil retests major support levels

3 - USD slides on jobless claims data; lower against all European majors and Yen, held onto slight gains vs AUD

4 - US yields moved lower across the board, short end outperforming

5 - Bitcoin recoups early losses ($89.3K) to close higher at $93K

Daily Price Activity

Insights

USD INDEX The sharp USD sell-off triggered by yesterday’s Fed rate cut followed through today with the index pushing down to test the lows last seen October 17th 2025. Buyers stepped in later in the US session, although trend, bias and sentiment are all tilted to the downside. The bearish feel results from the lack of any hawkish hints from the Fed’s accompanying statements. Resistance at 98.40 with support at 97.77.

S&P 500 In stark contrast to the USD sell-off, the index put in a strong showing. Early in futures trading yesterday’s gains were wiped out, however buyers stepped in and went on to recoup the losses and set a record high in the process. The close matches that of yesterday, as buyers look up to the 7000 mark. Mood and sentiment bullish, matching the technical uptrend. Resistance at 6969 with support at 6877.

GOLD Following the rest period which started at the beginning of the month, buyers confirmed demand for the safe-haven commodity is back on track, reaching the highest level since October 21st 2025. Note the ascending trendline. As long as sellers remain on the sideline, buyers will be aiming at the all-time high at $4380. Resistance at $4282 with support at $4205.

BRENT OIL Sellers stepped in from the outset, wiped out yesterday’s small gains, and went on to match the lows from mid October 2025. Buyers did step in through the afternoon portion of the US session, however the downtrend remains firmly intact. Buyers have guarded the $61 support area from a technical perspective, however the overall bearish momentum may see sellers re-try the push lower. Resistance at $62.63 with support at $60.74.

BITCOIN Sellers started early in the session, again breaking below the $90K level. The attempted push lower was short lived as buyers stepped in, recouped losses, and went on to match yesterday’s close levels. The dragon-fly candlestick with a long wick is a bullish reversal sign. Also, note the retracement back above the ascending trendline which adds to the bullish feel. Buyers will look up to the $94K area in an attempt to re-establish a meaningful uptrend. Sellers continue to aim below $90K. Resistance at $92K with support at $89.3K.

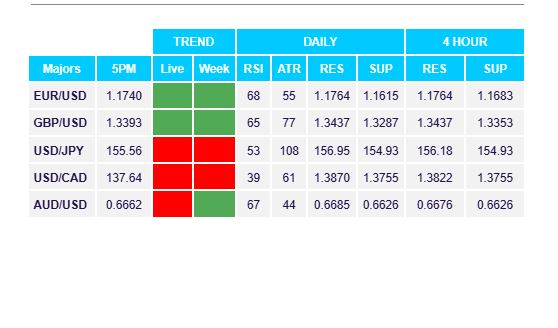

FX Pivot Levels