Market Highlights

1 - US indices close higher after Fed 0.25% rate cut; DJ +0.5% (record high), S&P +0.67%, NASDAQ +0.33%

2 - USD moved lower after the decision; EUR -0.58%, JPY -0.58%, GBP -0.65%, CHF -0.78%, CAD -0.35%, AUD -0.57%

3 - BOC keeps rates unchanged at 2.25%, as expected

4 - US yields lower across the board; 2yr -7.5bps, 5yr -4.9bps, 10yr -3.5bps, 30 yr -1.3bps

5 - Gold up $19 at $4228; BTC unchanged at $92.4K

Daily Price Activity

Insights

USD INDEX The Fed cut by 25 bps, as expected, and the USD was sold-off, as is the norm. The accompanying statement had a dovish feel as sellers took control and maintained through the close. Today’s move confirmed the downtrend on the charts, which started November 24th 2025. Looking ahead, the upcoming Asian and European sessions have digested the reaction and will set the pace for the new trading day. Resistance at 98.89 with support at 98.21.

S&P 500 As per the textbook, Fed cut, USD sold-off and equities strengthened. Buyers added to the existing uptrend which started November 21st 2025. Today’s rally set a record high, taking out the resistance set on October 30th 2025. Significantly the 6900 level was broken to the upside as buyers will be aiming at the 7000 level. Resistance at 6968 with support at 6845.

GOLD A rather subdued move higher as the metal put in a weekly high, although price activity remained very much within the recent range. Notwithstanding trend, bias and sentiment are all tilted to the upside, buyers did not step in with much conviction. Next upside target remains a break above the $4240 area. The safe haven commodity’s status remains intact and with geopolitical conflicts unsettled and the strong USD sell-off, the next meaningful move appears to favour the upside. Resistance at $4241 with support at $4185.

BRENT OIL Following an early push lower which added to yesterday’s move, buyers did step in and recouped yesterday’s losses. While today’s bounce certainly halted the slide, the overall picture still has a bearish feel with a lower high and lower low on the chart. Note the descending trendline which is shaping up as the next upside target. Resistance at $62.74 with support at $61.36

BITCOIN Buyers started strong and tested yesterday’s resistance, before sellers stepped in and reversed the gains. At the end of the day, the close matched that of yesterday. See the doji-like candlestick confirming the indecision. Trend and bias remain tilted to the upside. Buyers will aim above $94.5K while sellers look below $90K. Note the ascending trendline which may dictate the next meaningful move. Resistance at $94.4K with support at $91.4K.

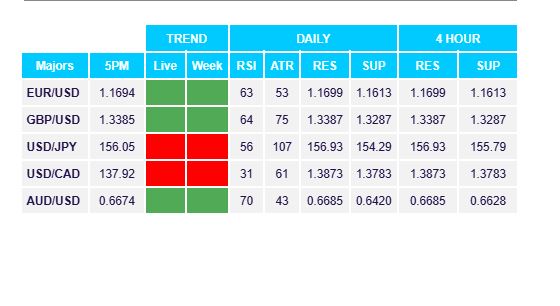

FX Pivot Levels