Market Highlights

1 - USD rises as traders anticipate hawkish Fed cut; AUDUSD correcting lower ahead of Rate decision - expected to keep rates unchanged; US yields higher across the board

2 - Major European indices close mixed; DAX and Ibex move marginally higher; FTSE and CAC lower

3 - US equities closed lower; DJ -0.45%, S&P -0.35%, NASDAQ - 0.14%

4 - Crude oil futures close down $1.20 at $58.88

5 - Gold down $7 at $4190; Bitcoin up $300 at $90.7K

Daily Price Activity

Insights

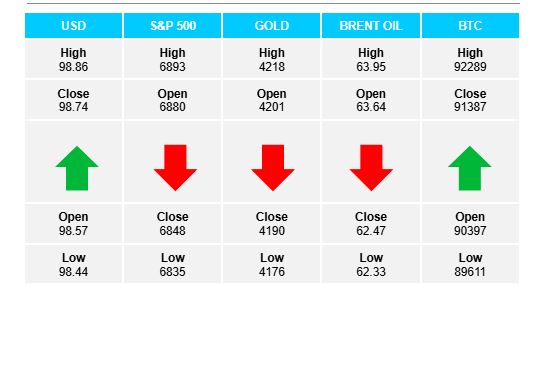

USD INDEX A solid start to the week as buyers guarded the support area, made gains and held on through to the close. The downtrend remains intact as activity remains contained within the 4-day sideways trend. Resistance at 98.85 with support at 98.44

S&P 500 Sellers controlled the day’s activity within the fading uptrend. The bias was negative across all major stock markets as traders look ahead to Wednesday’s Fed announcement. Sellers looking down at 6800 while buyers aim higher at the 6900 level. Resistance at 6894 with support at 6834.

GOLD Neither buyers or sellers made any significant moves as price action remained contained within a narrow $35 range. The $4200 level looks like the new comfort zone as sideways activity continues. The slight push lower is reflected as a lower high and lower low on the chart, doing just enough to signal a downtrend as EMAs crossed down. Resistance at $4219 with support at $4175.

BRENT OIL Sellers started the week erasing last week’s gains and in so doing added to the sideways trend within a broader downward bias. Note the strong support level which has been defended by buyers since early last week. Resistance at $63.94 with support at $62.33.

BITCOIN Buyers were unable to hold onto early gains, doing just enough to secure a green candlestick and add a higher high and higher low on the chart. The daily range continues to be relatively narrow as the $90K level could be shaping up to be pivotal. In order to establish a meaningful trend, buyers are aiming above $94K with sellers looking below $88K. Resistance at $91.4K with support at $89.5K.

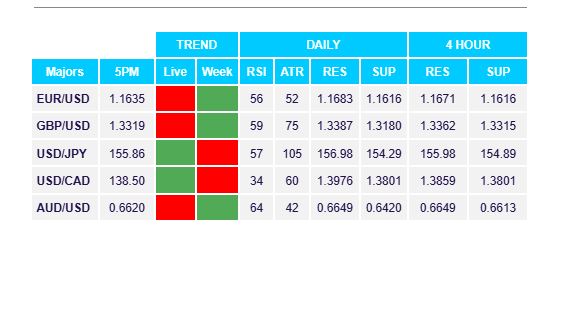

FX Pivot Levels