Market Highlights

1 - Major US stock markets closed with solid gains; NASDAQ +2.69%, S&P +1.55%

2 - US yields end day lower; 5yr -1.8bps, 10yr -3.2bps, 30yr -4.1bps

3 - Oil rebounded today, up $0.91 to $58.97

4 - Gold up $74 to $4138; bitcoin rebounded up $2000 to $88.7K

5 - USD closed mixed with uncertainty about Dec rate cut; gained against Yen and CAD, weakened against EUR, GBP, CHF and AUD

Daily Price Activity

Insights

USD INDEX Sellers did enough to pause the 6 day rally, without having the momentum to reverse the uptrend. Buyers fought back from an early sell-off with a close above the 100. 00 mark. Resistance at 100.21 with support at 99.93.

S&P 500 Following a sizeable gap up to start the week, buyers put in a strong showing for a 2nd consecutive day with a higher high and higher low on the chart. The close above 6700 was positive, with sellers staying away for the day. Resistance at 6729 with support at 6624.

GOLD Buyers took control from the outset and went on to erase last week’s mild losses and in so doing initiated a new uptrend to start the week. Price action closed above $4100. Next target on the upside is the descending trendline on the way to revisiting the $4200 level. Note the traditional inverse relationship between weak USD and strong gold. Resistance at $4139 with support at $4036.

BRENT OIL Buyers stepped in and halted the preceding downtrend with a strong bounce up and closing above Friday’s high. Buyers will aim to add to today’s gains and break above the $63 level, while sellers look below $62 to bring price action back within the new lower range. Resistance at $62.96 with support at $61.35.

BITCOIN Buyers withstood an early test of support, and then went on to put in a strong rally through the US session. Higher highs and higher lows on the chart, with the EMAs gently crossing to the upside. Today’s activity produced the first “2 consecutive green candlesticks” since the sharp sell-off from November 11 2025. A break above $90K could pave the way for further gains with plenty of room on the upside. Resistance at $88.9K with support at $85.1K.

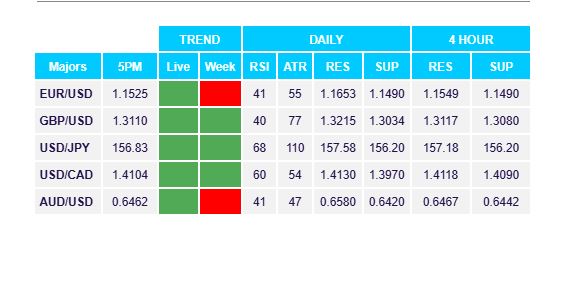

FX Pivot Levels