Market Highlights

1 - US votes to reopen the government

2 - USD/JPY surge above 155.00 heightens intervention risk; AUD jumped higher on strong job numbers - no RBA cut ahead? CHF leads, JPY lags

3 - Mixed day for US stocks. The rotation out of tech and into Dow stocks continue. Dow closes at record high, NASDAQ closes lower and S&P near unchanged

4 - Gold and Bitcoin head in opposite directions

5 - US 10yr yields down 4bps; WTI crude down $2.59 to $58.45

Daily Price Activity

Insights

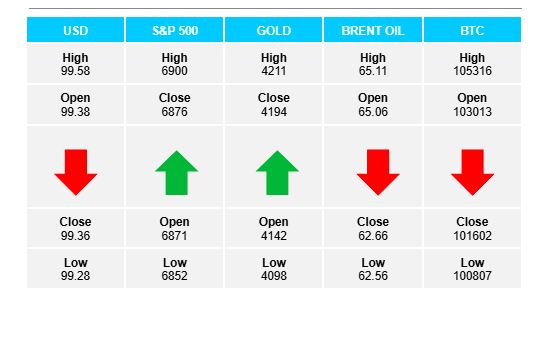

USD INDEX Following an early rally, buyers could not hold on and sellers stepped in, reversed the day’s gains and went on to close slightly lower than the open, alongside yesterday’s close. The downtrend remains intact, although the trend has taken on a sideways feel since the start of the week. Resistance at 99.59 with support at 99.27.

S&P 500 The index closed flat after brief attempts both higher and lower. The doji-loke candle confirms the indecision. However, today’s candlestick does reflect a 4th consecutive higher high and higher low on the chart. While demand is limited, sellers are not yet ready to take control. Resistance at 6900 with support at 6852.

GOLD Buyers remain in control as the uptrend gathers steam with the 5th consecutive higher high and higher low on the chart. Following the bounce up from the pivotal $4000 mark, buyers have broken through $4100, and now $4200 resembling what we saw in the previous rally from August 2025. While demand for the safe haven commodity is clear, profit taking may enter the picture as buyers look back to the sharp sell-off last month, October 2025. Resistance at $4211 with support at $4095.

BRENT OIL Sellers put an end to the brief uptrend with a sharp reversal which saw the price drop by $2.50. Buyers stood on the sideline as sellers put in the lowest close since October 22, 2025. In one day trend, bias and sentiment all pointing down. Resistance at $65.12 with support at $62.54.

BITCOIN Sellers added to yesterday’s sell-off adding to the strong push lower. The descending trendline contained price activity as the new downtrend (EMAs crossed down) was confirmed. Note the strong support around the $100K area which buyers continue to guard. While sellers look down at $98K, buyers will look to retest above $104K, at a minimum, in an attempt to make a meaningful bounce. Resistance at $105.4K with support at $100.7K.

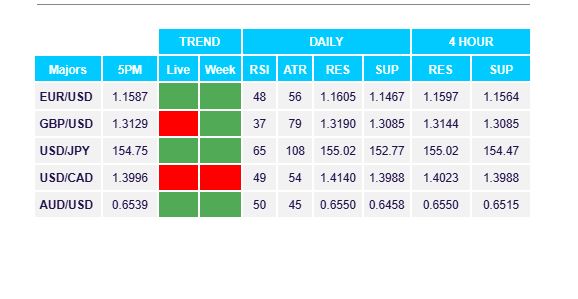

FX Pivot Levels