Market Highlights

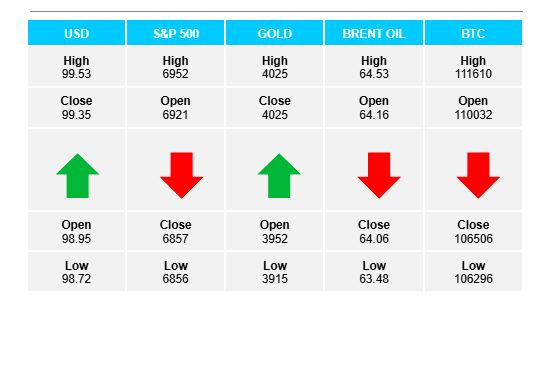

1 - Major US indices close at session lows. NASDAQ -1.57%, S&P -0.99%; Meta tumbles; Amazon announces strong earnings after the close

2 - Gold up $95 and back above $4000; Crude up $0.09, settles at $60.57

3 - European indices close lower to unchanged. DAX and FTSE unchanged, CAC - 0.53%, Ibex -0.68%

4 - ECB keeps rates unchanged, as expected. Lagarde: inflation unchanged, economy should benefit from consumption, labour cooled

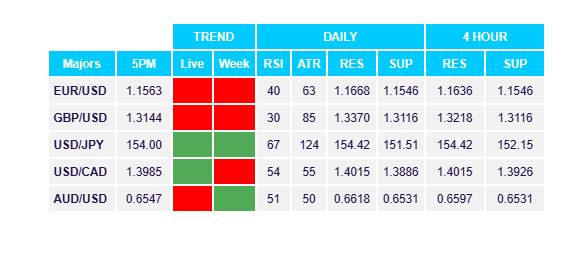

5 - AUDUSD falls sharply but finds support at key MA levels; USDJPY higher after BOJ rate decision

Daily Price Activity

Insights

USD INDEX Buyers added to yesterday’s rally confirming a mini resurgence/ demand for USD. Today’s resistance level marks a 3 month high for the world’s reserve currency. Buyers will aim for the 100.00 level while sellers will look below 99.00 as a minimum to reversing the trend. Resistance at 99.53 with support at 98.72

S&P 500 After a brief test of yesterday’s record high, sellers took control and never gave it up through to the close. This week’s gains were all erased as buyers remained on the sidelines. Note yesterday’s bearish engulfing candlestick played out, combining with today’s double-top candlestick formation - both strong reversal signals. The sell-off was in sharp contrast to the USD rally - the traditional inverse relationship between strong USD vs weak equities. Resistance at 6952 with support at 6854.

GOLD Gold bounced up off support, and in so doing erased losses from the past 2 days. Significantly the metal closed above the pivotal $4000 mark. Noteworthy that gold moved in tandem with the USD, (both higher) as opposed to the traditional inverse relationship between the 2 asset classes. Notwithstanding the move higher today, the daily downtrend remains in place. Resistance at $4025 with support at $$3909.

BRENT OIL . Neither buyers or sellers were able to extend brief moves in either direction, before settling alongside yesterday’s close. Sellers did enough to end the day slightly lower than the open, however sideways best describes the activity over the past 2 days. While technically the trend remains up (EMAs), today does mark the 4th consecutive lower high on the charts. Resistance at $64.55 with support at $63.50.

BITCOIN Sellers dominated price activity with a strong sell-off, confirming a clear downtrend on the daily charts. Sellers were not able to maintain below the current support area earlier in the month (October 17 2025). The strength of the move added a lower high and lower low for the 4th consecutive day. Sellers will aim to re-test $103K on the way to eyeing the $100K level. Buyers will be looking up at the $110K mark. Resistance at $111.6K with support at $106.2K.

FX Pivot Levels