Market Highlights

1 - Fed cuts but Powell says December is up in the air, “ we haven’t made a clear decision”; Bank of Canada cuts rates by 25 bps, as expected

2 - Crude moved higher by $0.23 at $60.38; USD moved higher after split vote from the Fed; Copper rises to all-time high

3 - Microsoft beats earnings and forecasts; Meta tops revenue and earnings expectations

4 - US stocks close mixed, DJ down, NASDAQ up, S&P unchanged

5 - US yields moved higher across the board; Gold lower on the day - $7.74 at $3944

Daily Price Activity

Insights

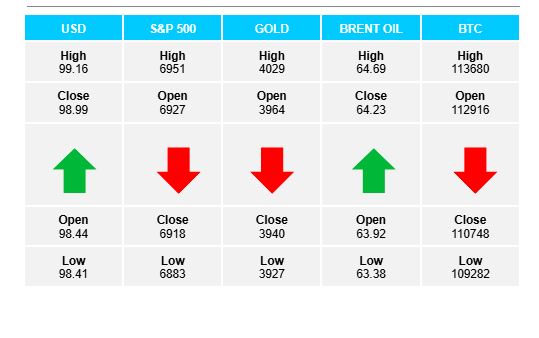

USD INDEX The USD rallied in response to the Fed rate cut earlier today. The statement by Fed chairman Powell, implying a further cut in December is not a sure thing, added to the sharp push higher. Buyers did enough to reverse the downtrend and break above the ascending trendline. Note the resistance level where sellers stepped in matches the same level we saw in the middle of the month. Resistance at 99.17 with support at 98.42.

S&P 500 Overall sellers won out today in a volatile US session. Early gains (and a record high) were reversed in response to the Fed rate cut, only to see buyers put in a late rally and end the day alongside yesterday’s close. Today’s activity resulted in an unconvincing bearish engulfing candlestick formation. Resistance at 6952 with support at 6879.

GOLD Sellers maintained control, adding to the well-established downtrend. The Fed’s rate cut contributed to the downward trend. Today was a clear illustration of the inverse relationship between strong USD and weak gold. Profit taking also contributing as prices move further below the $4000 level. Resistance at $4032 with support at $3929.

BRENT OIL Although buyers won out today and the uptrend remains intact (EMAs up) there are conflicting technical signs - a 4th consecutive lower high adds to a negative bias and feel on the daily chart. Note sellers got held up at same support level as yesterday. Resistance at $64.66 with support at $63.33.

BITCOIN Notwithstanding a rally late in the US session, sellers won out today and added a 3rd consecutive lower high and lower low on the chart. Note the support area (below $110K) which buyers have successfully defended since July 2025. While the uptrend remains in place, it appears there is a negative bias surrounding bitcoin with limited follow through in the recent bouts of buying/demand. Sellers will aim below $109K in order to reverse the trend.

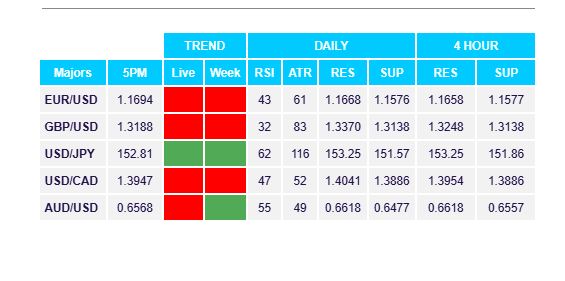

FX Pivot Levels