Market Highlights

1 - Morgan Stanley notes USD comeback but warns of fragile rally; AUD breaks above 100 day MA, swing area and 38.2% fib level

2 - US stock markets rally to record high closes: S&P +1.2%, DJ + 1.5%, NASDAQ +1.9%

3 - WTI crude down $0.15 to $61.35; OPEC + leaning toward another modest output increase at next meeting

4 - US 10 yr yields down 1bps; Gold down $120 to $3990

5 - European indices close higher; DAX +0.68%, CAC +0.16%, ftse +0.08%, Ibex +0.87%

Daily Price Activity

Insights

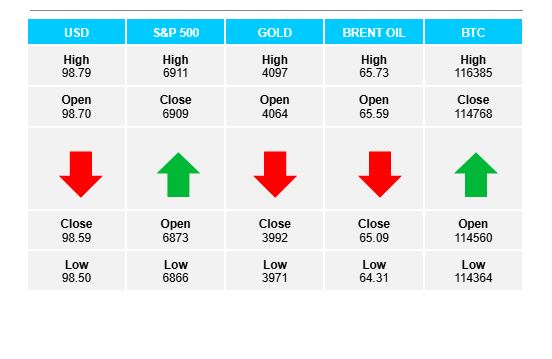

USD INDEX Sellers won out today starting the week by adding to the downward bias and extending the downtrend with a 3rd consecutive lower high on the chart. However, although the technicals confirm the downtrend, price activity continues to move sideways as the close price remains within a narrow range. Resistance at 98.80 with support lower at 98.49.

S&P 500 A gap up to start the week, followed by buyers confirming demand throughout the day. The solid performance resulted in a record close for the index. Note the traditional inverse relationship between a weak USD and strong equities playing out. (DJI and NASDAQ also had record high closes). Resistance at 6911 with support at 6864.

GOLD After consolidating around the $4100 area, the metal was sold off throughout the day with the significant $4000 support level being tested, and broken. Note break below the ascending trendline. Interesting that the USD and gold had a positive correlation, both moving lower on the day. The downtrend which started off a triple top candlestick formation remains firmly in place. While gold’s safe haven status remains intact, technicals and profit taking appear to be the driving forces for the move lower. Resistance at $4099 and support at $3968.

BRENT OIL Following up on the early gap higher to start the day, sellers did enough to secure a lower close reflected with a red daily candlestick. Buyers did fight back in the session and went on to close alongside Fridy’s close price. Buyers eyeing the $66 mark in an attempt to add to the existing uptrend. Bias and sentiment favour the upside. Resistance at $65.74 with support at $64.26.

BITCOIN Buyers tried higher but were unable to hold on to gains. Sellers stepped in and brought prices back to close within the $115K area. Note the fibonacci retracement tool measuring the drop from the $126K high down to the $103K low - buyers have not been able to maintain above the 50% fib retracement level at $115K. Sellers will aim below $112K. Resistance at $116.4K with support at $114.4K.

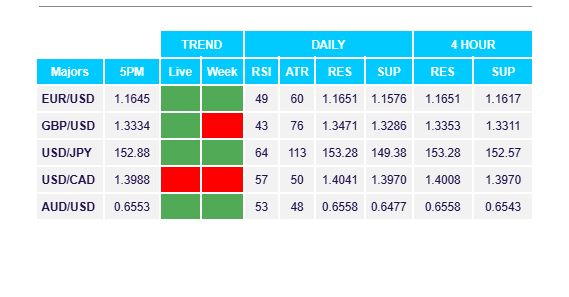

FX Pivot Levels