Market Highlights

1 - Major indices move higher, led by NASDAQ; DJ +0.315, S&P +0.58%, NASDAQ +0.89%

2 - US debt market, yields move higher: 5yr +5.9bps, 10yr +5.4bps, 30yr + 4.8bps

3 - Goldman Sachs stands by $4900 forecast despite 6% price dip

4 - Bitcoin up $2000 on the day; major European indices close higher on the day

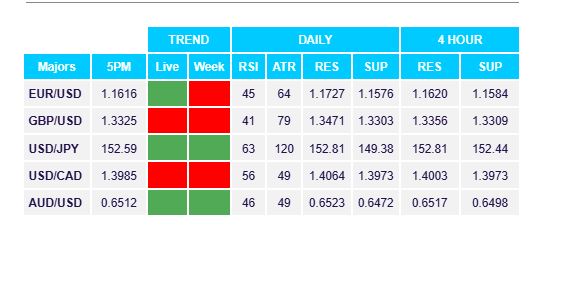

5 - USD moved mostly lower with GBP and JPY the exceptions

Daily Price Activity

Insights

USD INDEX An early push higher in the Asian session was short lived. Sellers stepped in during the European and US sessions resulting in the index closing where it started. While the overall bias and trend remain up, technically at least, price action has been limited and sideways would best describe the current trend. Resistance at 98.93 with support at 98.70.

S&P 500 Buyers won out today and wiped out yesterday’s losses, ensuring the uptrend remains intact. Neither buyers or sellers have managed 2 successive days of trending with price activity maintaining slightly below the 6800 area. Note current resistance levels have held strong this week with buyers struggling to reach the record highs from earlier this month. Resistance at 6786 with support at 6716.

GOLD Although buyers won out today, (marginally) prices closed alongside yesterday’s close price. Bias and trend are tilted to the downside as buyers have not yet recovered from the huge sell-off early in the week (Tuesday 21 2025). Buyers were held up at yesterday’s resistance level, while sellers will aim to re-test the $4000 mark. Gold clearly retains its safe-haven status, however there has been a lack of demand following the recent reversal. Resistance at $4156 with support at $4061.

BRENT OIL Oil rallied for the 3rd consecutive day as sellers remain on the sidelines. Technically the uptrend appears to have gained momentum, possibly as a result of fundamentals adding to the rally - supply concerns and geopolitical conflicts contributing to the demand. Resistance at $65.62 with support lower at $63.37.

BITCOIN Buyers stepped in from the start, doing enough to reverse the trend and retest the $110K resistance area. While buyers aim above the pivotal $112K level, sellers will continue to look down below the $107K support area - the level buyers have guarded successfully since July 2025. Resistance at $111.3K with support at $107.5K.

FX Pivot Levels