Market Highlights

1 - Crude oil settles at $58.50; White house says crude oil is a great buy

2 - Gold adds on to the declines from yesterday

3 - European indices close mixed; DAX -O.71%, CAC -0.63%, FTSE +0.93%, Ibex +0.11%

4 - US yields slightly lower; 30yr -1.3bps

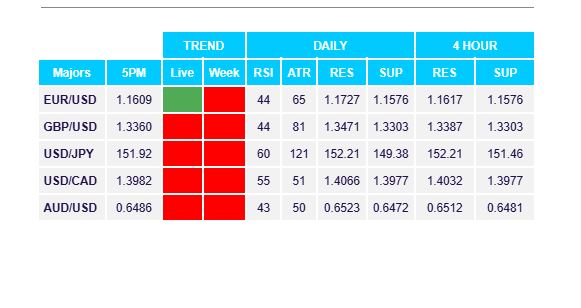

5 - USD/JPY rises to 8 day high; USDCAD trades to new lows as sellers react to 100/200 MAs

Daily Price Activity

Insights

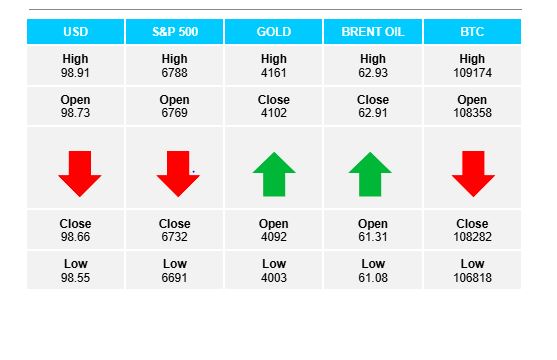

USD INDEX Buyers failed to add to the past 3 day’s gains, with neither side making a lasting move. Following a gentle test in both directions, prices closed back where it started, alongside yesterday’s close. A doji-like candlestick confirmed the lack of direction. Resistance at 98.90 with support at 98.55.

S&P 500 Sellers won out on the day, notwithstanding a strong late afternoon rally into the close. Following yesterday’s doji candlestick and today’s red candle, it appears that demand, and record high closes, have given way to profit-taking and a retracement in the S&P index. Note the current resistance area holding strong. Resistance at 6786 and support at 6693.

GOLD Although buyers did step in to recoup further losses from earlier in the day, and prices closed slightly higher than the open, the bias remains down following yesterday’s sharp decline. Note the $4000 mark was defended by buyers looking to establish a floor at the strategic level. Resistance at $4164 with support at $4005.

BRENT OIL Buyers put in a strong push higher, adding to yesterday’s gains and in so doing signalling a new uptrend on the charts (EMAs reversed/crossed to the upside). Resistance at $63.48 with support at $61.11.

BITCOIN Buyers and sellers both had a brief test before settling back alongside yesterday’s close. The lower high and lower low on the chart add to the bearish feel. Today’s price activity was contained within a narrow $2.5K range. Resistance at $109.2K with support at $106.8K. Sellers appear to have the upper hand with activity remaining below the $110K level. Buyers will aim to test the pivotal $112K mark.

FX Pivot Levels