Market Highlights

1 - Gold up $110 to $4319; Bitcoin down 2.3%

2 - WTI crude down 40.81 to $57.46

3 - S&P down 0.63%, DJ -0.65%, NASDAQ -0.47%

4 - CHF leads, AUD lags; Westpac: USD strength driven by overall yen weakness

5 - US 10yr yields down 7.1bps; US jobless claims seen falling, but labour market remains sluggish

Daily Price Activity

Insights

USD INDEX A 3rd consecutive day of lower highs and lower lows as sellers add to the downtrend. The mood and sentiment appear bearish as sellers have aggressively erased the gains from last week. Resistance at 98.46 with support at 98.04.

S&P 500 Sellers dominated price activity today, wiping out the modest gains made this week following last Friday’s extreme sell-off. Resistance at 6751 with support at 6632. While the downtrend remains intact, the week’s activity has traded sideways. Note that buyers have defended the current support area for the past month. Also interesting that the trend is moving in the same direction as the USDX - both downtrends.

GOLD Not only did the trend continue, it picked up steam as the metal rallied over $120 on the day. Today signalled the 4th consecutive new record high following the break of $4000 to start the week. Resistance at $4327 with support at $4203. Technicals, fundamentals and sentiment reflect an unparalleled demand for the safe-haven commodity. With an uncertain USD, nervous stock markets reacting to the US-China trade/tariff conflict, it seems financial markets have no place else to invest. Although some degree of profit taking is expected, buyers have been relentless as FOMO continues to grip the market.

BRENT OIL Sellers won out for the 6th consecutive day as buyers remain on the sidelines with limited, if any demand for oil. Reports of over supply adds to the one-way slide. Resistance at $62.33 with support established at $60.54 -the pivotal $60 mark is well within sight. Trade war fears (US-China) and renewed talk of a global economic slowdown all factoring into the sell-off.

BITCOIN Earlier in the month when the cryptocurrency reached a new record high (October 6th 2025) at $126K, there were whispers of BTC being viewed as a new safe-haven investment. Since then, sellers have responded with a $19K sell-off as buyers struggle to fight back with any substance. Resistance at $111.9K with support at $107.4K. A break of current support area could see sellers target the $100K level. First target on the upside remains the $112K area.

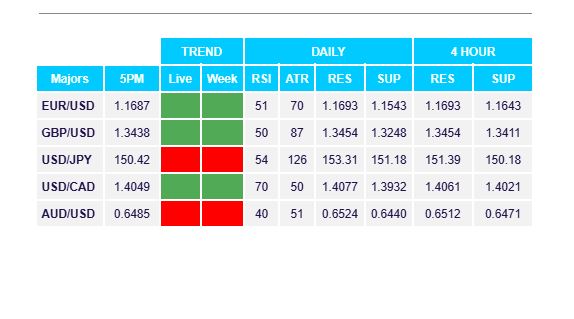

FX Pivot Levels