Market Highlights

1 - Spot gold traded above $4000 for the first time; spot silver also extended to the upside

2 - S&P and NASDAQ set records once again, DJ closes unchanged

3 - Crude oil futures settle at $62.55, up $0.82

4 - The USD moved mostly higher against the majors; except for commodity currencies - USDCAD unchanged, AUDUSD -0.11%

5 - US yields end day higher; 2yr +1.6bps, 5yr +1.6bps, 10yr +0.4bps, 30yr +0.5bps

Daily Price Activity

Insights

USD INDEX Demand for the global reserve currency continued with buyers firmly in control as significant resistance levels are approached. Todays high was last seen August 5th 2025. Resistance at 98.78 with support below at 98.36. Notwithstanding today’s green candlestick, a late retracement during the afternoon period of the US session was enough to signal a reversal (EMAs crossing down) on the shorter time frames.

S&P 500 Buyers wiped out yesterday’s losses and went on to set a new record close for the index. (NASDAQ also closed at a new record high). The US government shutdown has had little effect on the demand for US equities, in fact with no data releases it seems investors have no reason not to continue buying US shares. Resistance at 6803 with support at 6758.

GOLD The metal has no concern for overbought technicals or the traditional inverse relationship between strong USD and weak gold, as demand for the safe haven commodity continues to pick up steam. New record highs on a regular basis as sellers show no interest for stepping in - why take profit when the price continues to move up? Geopolitical concerns and global financial uncertainty add to the demand. Trading in unchartered territory gives traders no technical barriers in the form of previous resistance levels, resulting in sharp moves to the upside. The $4000 level was reached and broken. Resistance at $4059 with support at $3984.

BRENT OIL Although sellers did step in late during the US session, buyers won out on the day and added a 4th consecutive higher high on the charts. The green candlestick was enough to signal a new uptrend - only just - on the daily chart. Resistance at $66.54 with support at $65.76.

BITCOIN Buyers responded to yesterday’s sell-off with a strong rebound, and recouped a large portion of the losses. The trend remains up and the higher low recorded on the chart confirms the bias remains tilted to the upside. Including today, 7 of the last 8 daily candlesticks are green suggesting positive sentiment for the cryptocurrency remains intact. Perhaps yesterday was a natural retracement following a new record high, extended with a bout of profit-taking, rather than a reversal. Resistance at $124.3K with support at $121.1K.

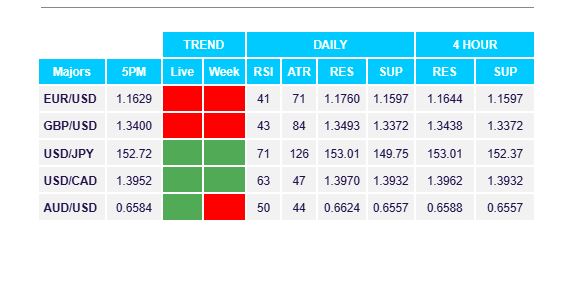

FX Pivot Levels