Market Highlights

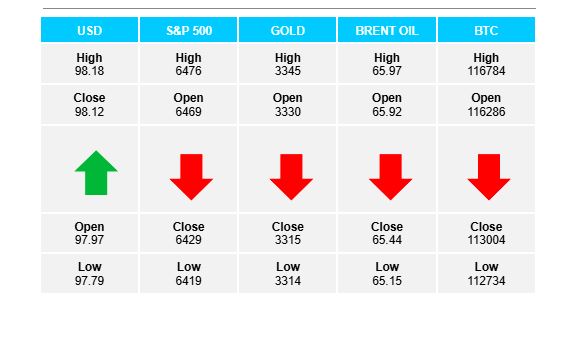

1 - USD closed mostly higher against the majors; exception was modest decline against JPY

2 - US stocks saw growth and momentum stocks sharply down; S&P -0.59%, NASDAQ -1.46%, DJ +0.02%

3 - US debt market yields moved lower despite USD rally; 2 yr -1.9bps, 5 yr -2.8bps, 10 yr -2.9bps, 30 yr -3.1bps

4 - European shares move higher as investors shift; funds shift out of US

5 - RBNZ expected to cut rates 25 bps later today

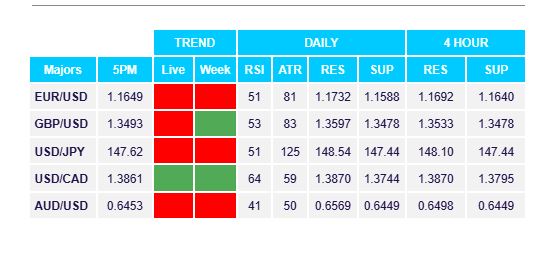

Daily Price Activity

Insights

USD INDEX A double bottom followed by 3 successive higher lows and EMAs crossing to the upside. Buyers have reversed the downtrend with steady demand for USD across the board. Resistance set at 98.18 with support lower at 97.78. Although technically the trend points up, price activity has been contained within a sideways range as the market debates the Feds next interest rate announcement, which is still a month away (Sept 17 2025). Buyers look above 98.50 while sellers aim below 97.50.

S&P 500 After setting new record highs last week, the equity index has reversed the uptrend with sellers taking control. Factors affecting the sell-off include profit-taking as well as the inverse relationship between strong USD and weak equities. Resistance at 6477 with support established at 6416.

GOLD The inverse relationship between strong USD and weak gold played out clearly today as the metal was sold-off sharply. The downtrend gained momentum with buyers standing on the sidelines. Contributing factors: the Ukraine-Russia conflict has entered a phase of optimism with Trump’s attempt to bring the 2 leaders together, coupled with the technical indicators adding to the move lower. Resistance at $3344 with support at $3314. Note the $3320 area has been broken as sellers now aim for the pivotal $3300 level, the floor previously protected by buyers.

BRENT OIL Sellers erased yesterday’s gains as price action was contained within a narrow range, trading a step lower than last week’s trading range. Trend and bias both tilted to the downside. Resistance at $65.97 with support lower at $65.14. Sellers continue to be influenced by the prospect of a global economic slowdown, while buyers watch for supply concerns relating to geopolitical conflicts.

BITCOIN Sellers continued the sell-off, adding to the well-established downtrend. Today’s $4K trading range saw resistance at $116.7K with support set at $112.7K. Note that this support area at $112k was tested at the beginning of the month (August 2nd and 3rd) when buyers stepped in and went onto set a record high at $124K.

FX Pivot Levels