Market Highlights

1 - US stocks close the day near unchanged with attention focused on the White House peace meeting

2 - European shares close mostly lower; UK FTSE 100 closes marginally higher

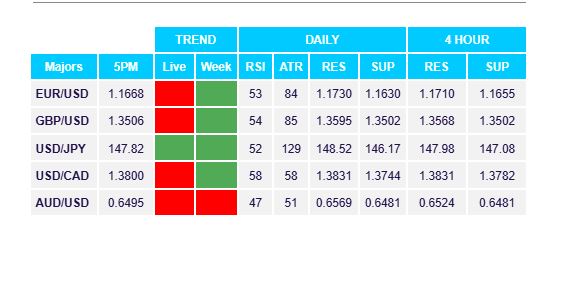

3 - USD closes the day mostly higher against all majors; USDJPY biggest mover

4 - US debt market - all yields modestly higher

5 - Goldman Sachs expects further USD depreciation due to economic underperformance

Daily Price Activity

Insights

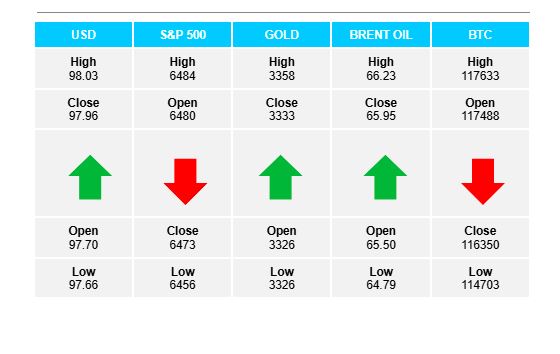

USD INDEX Buyers won out today with the USDX making gains within the daily downtrend. The positive feeling seemed to stem from the hope for peace as Trump headed the meeting between Ukraine and the European leaders at the White House. Lack of US data and no new fundamentals regarding interest rates kept sellers on the sidelines. Support sits at 97.67 with resistance at 98.03.

S&P 500 The stock markets were quiet with the S&P making no move in either direction. The doji-like candlestick confirms the lack of direction. Note that although buyers did not add to last week’s gains, sellers also chose to stay away. Resistance at 6484 with support lower at 6456. EMAs continue to point upward, although today’s candlestick reflects a lower high and lower low on the chart.

GOLD Buyers made an early move higher, only for sellers to step in and erode the majority of those gains. The bias remains down, and today’s bearish candlestick adds to the downtrend. Resistance was established at $3358 with support set at $3326. The current support area continues to hold strong. Price activity appears comfortable between $3320 and $3350, with 5 consecutive daily closes within the range.

BRENT OIL Sellers made the first move and went on to establish a significant new monthly low. Buyers stepped in and recouped the losses on the way to closing higher and adding a green candlestick to the downtrend. Support set at $64.77 with resistance at $66.23. The next meaningful move could take direction from the outcome of the current peace negotiations re. Ukraine and Russia being held at the White House.

BITCOIN A red candlestick added to the downtrend. Sellers pushed lower through the European session, followed by buyers stepping in through the US session. Resistance at $117.6K with support lower at $114.6K. Note the support matches the low from July 25 2025. EMAs down, bias down, and the bearish engulfing candlestick from last week continues to play out.

FX Pivot Levels