Market Highlights

1 - Citi says oil could drop to $60 on a US-Russia deal; Bitcoin rose by $2600, at record levels

2 - Hong Kong’s central bank intervened again to support the HKD; European shares rise on hopes for peace

3 - Goldman Sachs say again they expect 3 rate cuts by end of 2025; list for Fed chair expands

4 - NASDAQ and S & P close at record highs; US debt yields lower across the board

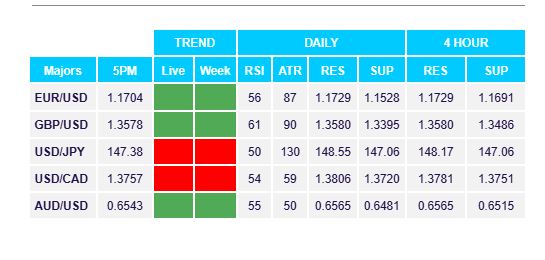

5 - US crude futures settle at $62.65, down $0.52; USD lower against all majors

Daily Price Activity

Insights

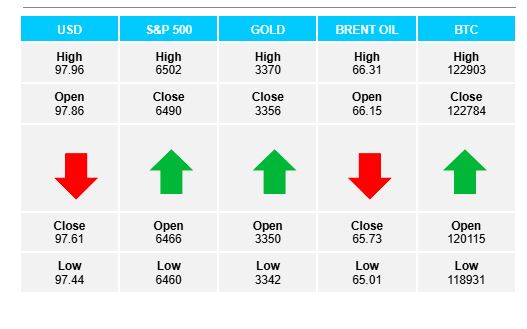

USD INDEX Sellers continued to dominate price action adding to the downtrend with a 3rd consecutive lower high and lower low on the charts. Resistance at 97.98 with support lower at 97.43. Demand for the global currency remains limited. Talk of a rate cut at the next Fed policy meeting, Fed chairman Powell being constantly threatened by Trump, and political instability all contributing to the negative sentiment surrounding the USD.

S&P 500 The demand for US equities continues as buyers control price activity across all major US stock markets. S&P made a new record high as sellers remain on the sidelines. Support at 6461 with resistance established at 6502. Note the inverse relationship between weak USD and strong equities confirmed. Overbought technicals and profit taking not ready to enter the market, just yet. No news is good news as buyers continue to look for reasons to join the rally.

GOLD Today’s pattern looks very similar to what we saw yesterday. A narrow trading range with buyers doing just enough to make a higher high and higher low on the chart, although the downtrend remains intact. The metal again looks comfortable trading around the $3350 area. Resistance at $3371 with support set at $3342. Note that the weak USD has not translated into strong gold - the usual inverse relationship between the two instruments. Geopolitical conflicts - Middle East and Ukraine - are not currently influencing a run on the safe-haven commodity.

BRENT OIL Sellers continued to push prices lower with another red candlestick-9 of the last 10 days -adding to the well-established downtrend. Resistance at $66.34 with support set at $65.04. Buyers did step in at the new low, erasing much of the day’s losses. The day closed at $65.75. Buyers will aim above $67 in an attempt to reverse the trend, or at least halt the slide.

BITCOIN Buyers made a strong push higher with demand for the cryptocurrency resulting in prices close to testing the record high set July 14 2025 ($123.2K). Today’s rally was fuelled by positive rhetoric from the White House regarding digital acceptance and crypto trading regulations - both adding to the strong technical picture which has pointed higher since the bounce up off support ($112K) at the start of the month. Resistance at $122.8K with support lower at $118.9K. New moves to the upside could be sharp as buyers enter unchartered territory. Sellers will aim below $120K in an attempt to retrace the trend.

FX Pivot Levels