Market Highlights

1 - GBP to fall against USD and Euro - pick your poison. BOE to cut again, and again

2 - US stocks close lower. NASDAQ hits intraday high before reversing lower

3 - Crude settles at $63.96, up $0.08; US yields end little changed

4 - Trump extends China tariff deadline by 90 days, Trump’s tariff income $29.6B in July - has it peaked?

5 - Trump: gold will not be tariffed; major European indices close mixed, German DAX, France CAC, Italy FTSE MIB decline

Daily Price Activity

Insights

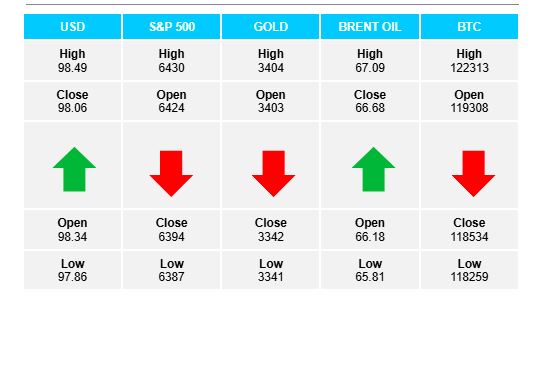

USD INDEX The USD started the week on a solid foot making gains across the board with the USDX adding to Friday’s bounce up off support. The buying started in the Asian and European sessions, leveling off at resistance levels during the US session. The move higher produced a higher high and higher low on the chart. Resistance set at 98.49 with support lower at 97.85.

S&P 500 Slow steady demand to start was reversed as sellers took control during the afternoon portion of the US session. Notwithstanding the push lower, today’s price action resulted in a higher high and higher low on the charts, with the uptrend hanging on, just barely. Resistance sits at 6430 with support lower at 6386. Note the inverse relationship between strong USD and weak equities.

GOLD Sellers set the tone early and never gave up control, in the process breaking the lows from the 5 previous days. Profit taking added to the strong sell-off as the technical picture turned bearish over shorter time-frames. Note the strong inverse relationship with strong USD and weak gold. The metal commodity has not lost its safe haven status, as buyers may well step in, recognizing the lower prices as potentially profitable buy opportunities. Resistance at $3405 with support lower at $3341.

BRENT OIL Again the $66 floor held strong as buyers protected the support area, putting an end to the 7 day sell-off with a higher low on the chart. Support sits at $65.82 with resistance slightly higher at $67.09. Trend and bias - fundamentals and technicals - all remain tilted to the downside. While sellers aim below $66, buyers look above $67 at a minimum in reversing the trend.

BITCOIN Buyers started early and broke above the $120K resistance in the Asian session. The rally was short lived as sellers went on to give up all the gains and eventually close lower following the European and US sessions. Resistance established at $122.3K with support set at $118.1K. Technically today’s candlestick is bearish, however the uptrend remains intact with higher highs and higher lows on the daily chart.

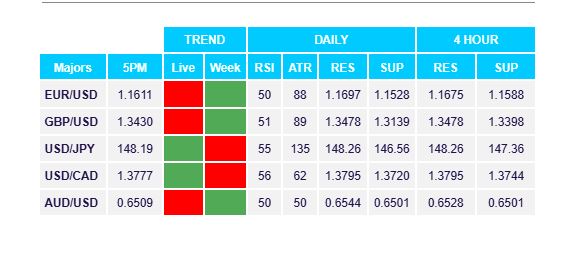

FX Pivot Levels