Market Highlights

1 - Rabobank forecasts USDCAD to trade 1.34 - 1.36 range as US Canada rate gap narrows

2 - Major European indices closed higher except for UK FTSE 100 after BOE cut rates by 25 bps

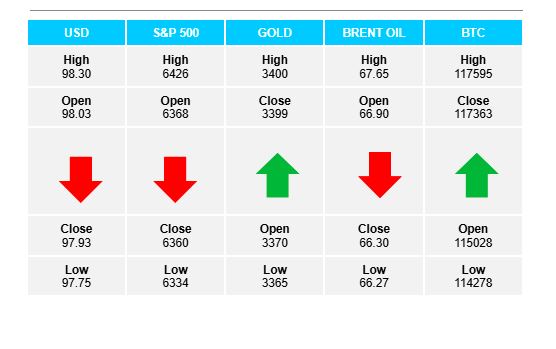

3 - US stocks closed mixed. DJ -0.51%, S&P near unchanged at 0.08%, NASDAQ +0.35%

4 - US yields close up across the board; Crude fell and testing $63.61 support area

5 - Bitcoin moved higher by $2456 at $117.8K

Daily Price Activity

Insights

USD INDEX Sellers added to the downtrend with a 3rd consecutive day of lower highs and lower lows on the chart. Demand for USD remains limited as the year long negative sentiment towards the global currency appears to have returned to the USDX. Resistance sits at 98.33 with support established at 97.44. Political instability within the US framework adds to the sentiment.

S&P 500 Buyers started early, yet the demand was short lived as sellers won out the day closing alongside yesterday’s close price. While we see demand for US equities, the stock markets trade nervously with the uncertainty/reality of the tariff outcome weighing on the mood. Technically the downtrend remains intact, although practically the trend moves sideways as neither side has been ale to hang on to intraday moves. Resistance at 6427 with support below at 6335.

GOLD The uptrend gathered momentum as buyers broke out of the week- long sideways range with demand for the safe haven commodity contributing to the strong $30 push higher. Support at $3365 with resistance set at $3400. Note the traditional inverse relationship between weak USD and strong gold playing out. Buyers will aim to break above $3400 while sellers will look below the $3350 area to reverse the trend.

BRENT OIL A 6th consecutive day of sellers adding to the downtrend saw a lower high on the charts and setup a retest of the strong floor which has been established and guarded by buyers. Resistance at $67.63 with support at $66.27. Global financial concerns and a potential economic slowdown appears to be the contributing factor - lack of demand.

BITCOIN A strong push higher saw a break of the week-long tight range as buyers confirmed demand for the cryptocurrency. Today’s rally was enough to signal an uptrend as the EMAs crossed upwards. The White House’s rhetoric regarding crypto acceptance and proposed easing of regulatory restrictions adds to the positive sentiment. Support at $114.2K with resistance established at $117.6K. Buyers look up to the $120K area.

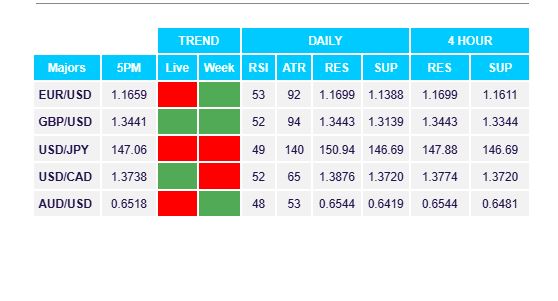

FX Pivot Levels