Market Highlights

1 - More record closes for S&P and NASDAQ

2 - GBP extends back to the 50% retracement; Buyers continue to take back control

3 - Trump says will have “simple straight” 15%-50% tariffs; Says in serious talks with EU

4 - UBS says US-Japan deal will be a drag on Japanese economy; BOJ on hold till 2026

5 - Tesla Q2 earnings a series of misses

Daily Price Activity

Insights

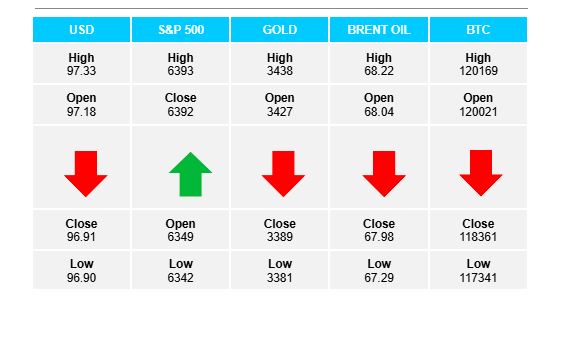

USD INDEX A familiar pattern today and this week. Buyers start early, sellers step in and dominate price action from US Open to close. 4th consecutive day of lower highs and lower lows. Resistance 97.33 with Support 96.88. Negative USD sentiment driving factor.

S&P 500 Demand for US equities at extreme levels. Tariff news adds to the positive mood. Sellers stand aside. Higher highs and higher lows contribute to classic uptrend. Resistance at 6393 with Support at 6346. Overbought technicals overlooked.

GOLD Technicals override fundamentals as the safe haven commodity reverses at resistance for 4th time since April 2025. Resistance at $3439 with Support at $3381. Noteworthy that gold and USD moving in the same direction - lower.

BRENT OIL Sellers make the first move lower at the start of the Asian/European sessions. Buyers step in at the US session and recoup losses. Price range matches yesterday. Resistance at $68.20 with Support at $67.27. Fundamentals not influencing price action.

BITCOIN Price activity within familiar $3K range between $117K and $120K. Past behaviour favours upside breaks following sideways ranging. Resistance at $120.2K with Support at $117.2K. Note loose pattern of lower highs since record high at $123K.

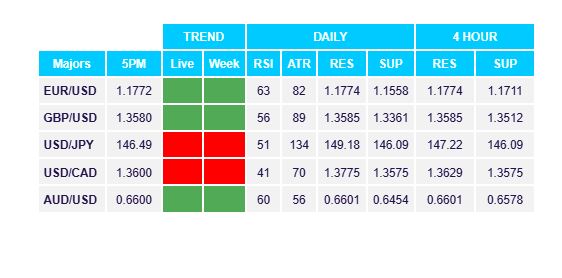

FX Pivot Levels