Market Highlights

1 - Trump firing Powell risks higher inflation, lower USD

2 - EUR may be shaken not stirred as markets voice concern but market shrugs off rate cut risk

3 - S&P and NASDAQ close at record levels; major European indices close mixed-Germany, UK, Spain higher, France and Italy lower

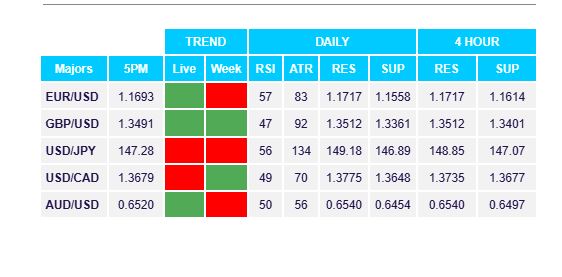

4 - AUD struggles to add gains as resistance holds; EURUSD and GBPUSD both broke above 200 day MAs

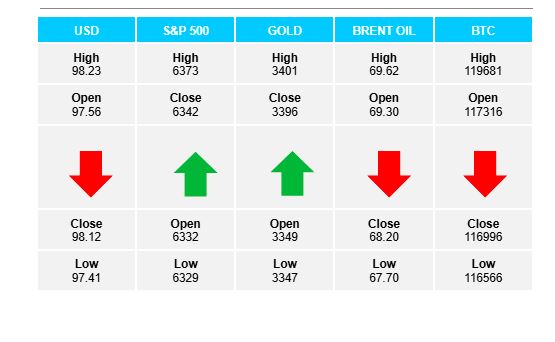

5 - Gold up $54 to close $3401; US yields all lower on the day; Crude settles at $65.95, down $0.10

Daily Price Activity

Insights

USD INDEX Sellers controlled the day with the USD sold off across the board - against the majors and confirmed with the USDX signalling a lower high and lower low on the daily charts. Resistance sits at 98.23 with support lower at 97.40 matching last week’s low (July 16). Buyers ran out of steam late last week and were unable to halt today’s slide with a lack of demand for the global currency.

S&P 500 A brief early rally at the start of the US session was short lived as sellers stepped in and ended the day back where it started - with buyers just hanging on to show a marginal gain on the day. Resistance established at a record 6376 high, with support set at 6327. The EMAs remains up with a higher high and higher low adding to the (sideways) uptrend.

GOLD Weak USD = strong gold. The traditional inverse relationship played out today with demand for the safe haven currency reflected in a strong green candlestick confirming the breakout following last week’s sideways price activity. Support stands alongside the open at $3346, with resistance matching the daily high at $3400. The trend is up, bias is up, and the June high at $3453 will be the next upside target. Sellers aim below $3350 in an attempt to reverse today’s move.

BRENT OIL Sellers won out and added to the downtrend, without either side hanging on to intraday moves. Resistance at $69.62 with support at $67.66 - matching the low from last week (July 16). Price action continues to move within a broad $2 sideways range for much of the month. The bias appears tilted to the downside.

BITCOIN Following the breakout, record high and subsequent sell-off back to where it started, neither buyers or sellers have made a move over the past week. Price range remains limited below $120K and above $116K. Technically, past behaviour favours a breakout to the upside following a period of sideways activity. The bias is slightly tilted to the upside based on the current strength of the support area. Resistance at $117.6K with support lower at$116.3K.

FX Pivot Levels