Market Highlights

1 - FT: Trump set to open retirement market to crypto investments

2 - Major US indices close higher. NASDAQ and S&P set record highs

3 - European indices close higher with DAX and CAC leading the way

4 - Crude oil futures settled 41.04 higher at $66.23; US yields mixed, 2 and 5 yr slightly higher, 10 and 30 yr slightly lower

5 - USDCAD bulls lose steam near major resistance. What next?

Daily Price Activity

Insights

USD INDEX Buyers started strong confirming demand for USD, before sellers stepped in giving up a portion of the early gains. Support sits at the 98.03 open price, with resistance established at 98.63 - matching the high from yesterday. The uptrend remains firmly intact as yesterday’s brief sell-off was corrected. Buyers will look at up at the 99.00 level, while sellers look for a continuation of the bounce down off current resistance.

S&P 500 Buyers were in control confirming the strong equity markets with both the S&P and NASDAQ setting record highs. Support sits at 6288 with resistance at a record 6345. Note the positive correlation between the USDX and S&P, both moving higher, as opposed to the traditional inverse relationship between the two indices. Again, no news is good news with the lack of news relating to tariff/trade deals having no impact on the demand for US equities.

GOLD The metal was sold off early in the Asian and European sessions, before rebounding back through the US session, to close slightly below the open. Support was set at $3309 with resistance matching the open at $3348. The safe haven commodity continues to trade within a well-defined range between $3300 and $3350. Today’s support was set at $3309 with resistance established at $3348. Trend, bias and EMAs all reflect the sideways price activity.

BRENT OIL After an early test lower, buyers stepped in and maintained control throughout the day. Support sits at $68.25 with resistance set at $69.57. Technically the trend is up, EMAs marginally crossed higher and bias tilted up, however the price activity shows the trend moving sideways, rather than higher or lower. Buyers will aim for the $70 mark on the upside, while sellers aim below $69 to initiate a move lower.

BITCOIN Sellers were first to make a move, yet the attempt was short lived as buyers stepped in and ended with a late push higher. A 3rd consecutive day of higher lows and matching highs shape up as an ascending triangle - a bullish formation. Support at $117.6K with resistance at $120K.

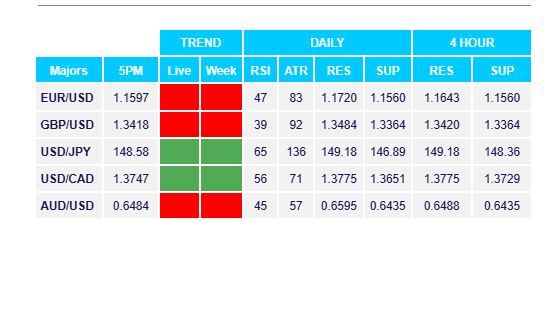

FX Pivot Levels