Market Highlights

1 - JP Morgan “Feds independence critical”. Goldman Sachs “Feds independence super important”

2 - Deutsche Bank warns of market turbulence early August - tariff deadline and jobs report

3 - US stocks closed higher; US yields lower across the board

4 - WTI crude futures settle at $66.38, down $0.14 on the day

5 - EUR/USD bounces after new lows and break below target fails

Daily Price Activity

Insights

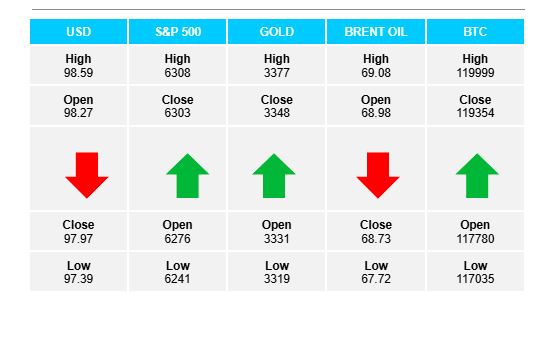

USD INDEX While the uptrend remains in place, sellers did step in and halt the month-long rally with a sharp sell-off. The charts show an attempted bearish engulfing candlestick (without a lower close) which is a strong reversal sign. Although buyers stepped in late the push lower did enough to reverse the trend on the shorter timeframes. Resistance at 98.61 with support established at 97.38. Note the red daily candlestick reflects a 5th consecutive higher high.

S&P 500 Buyers won out on the day with a green candlestick confirming the close higher than the open. Although the lower high and lower low add to the downtrend, the sideways activity continues as buyers and sellers continue to trade within a narrow sideways range. Resistance sits at 6308 with support lower at 6241.

GOLD Buyers maintained control with a $3347 close sitting in the middle of a well-established range. Resistance set at $3378 with support lower at $3320 - matching yesterday’s low/support. The bias remains tilted to the upside as sellers struggle to push below current support levels while buyers succeeded in making a higher high on the chart.

BRENT OIL After an early sell-off buyers stepped in to recoup losses and close alongside yesterday’s close price. Support set at $67.62 with resistance established at $69.10. 3 consecutive down days with lower highs and lower lows has been enough to confirm a downtrend on the daily chart.

BITCOIN Buyers put a stop to yesterday’s sharp move lower with a strong showing confirming demand for the cryptocurrency. Although sellers stepped in late, the uptrend was maintained with a higher low adding to the EMAs and bias both favouring the upside. Support was set at $117K with resistance established at $120K - perhaps a new pivot level going forward.

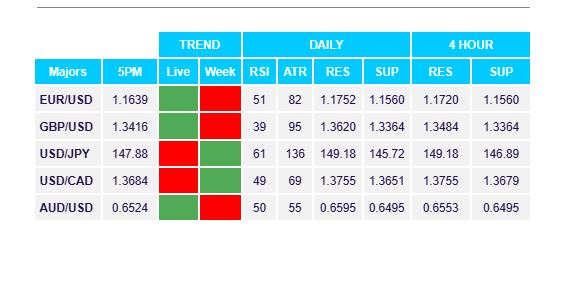

FX Pivot Levels