Market Highlights

1 - US stocks close mixed. NASDAQ closes at record high, S&P closes lower after intraday high; European indices close lower

2 - Crude settles at $66.52, down $0.46; US yields higher across the board

3 - Canadian PM Carney: US tariffs may be here to stay; NZDUSD volatile, bearish pressure builds

4 - Bitcoin retraces after record highs yesterday; USDX higher for 7th straight session

5 - HK central bank continues intervention; Japanese 10 yr yields highest since 2008, 20 and 30 yr reach record highs

Daily Price Activity

Insights

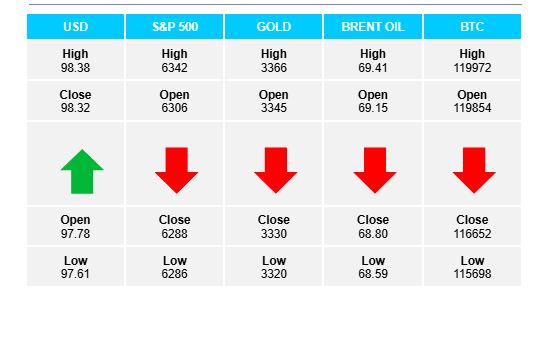

USD INDEX For the 4th straight day, and 8 of the past 10 days, the USDX has moved higher with buyers confirming demand for the USD. Traditional inverse relationship between strong dollar and weak equities. Resistance established at 98.39 with support lower at 97.60. Negative sentiment which has surrounded the USD since the start of the year is taking a backseat to the current bounce up from the July 1st low at 96.00.

S&P 500 Following the record highs in the S&P, sellers stepped in to cap the rally, at least for today, and allow for profit taking and a natural retracement. The index continues to trade within a narrow range since the start of the month with the bias tilted to the upside. Resistance at 6342 with support at 6285. Interesting that ongoing tariff changes with on again off again announcements and delays, the market continues to show demand without seeming too bothered. Also no updates on China and the EU play into the theme of no news is good news.

GOLD Today saw gold sold-off for the 2nd consecutive day with sellers maintaining control and the metal playing out as per the traditional inverse relationship between strong USD and weak gold. The price activity continues to trade comfortably within the broad range between $3300 and $3350. Today’s resistance sits at $3365 with support established at $3318. The recent pattern seems to be reacting to technical patterns rather than any particular fundamental factors at play. Clearly gold has not lost its safe haven status and trading above $3300 should be seen in perspective: the commodity was trading at $2585 at the start of the year.

BRENT OIL Sellers added slightly to yesterday’s sell-off and doing enough to signal a new downtrend on the daily chart. Resistance at $69.40 with support lower at $68.54 - matching the low from July 10th and 11th. Sellers will aim below $68, while buyers look up to the $70 level. While geopolitical issues remain unsettled and tariffs continue to be postponed, supply and demand issues have kept prices relatively stable.

BITCOIN An expected retracement from the record setting past 5 days saw sellers step in and make a noticeable dent in the current rally. Resistance at $120K (yesterday’s close) with support established at $115.6K. The uptrend remains intact on the daily chart with reversals on the shorter timeframes. Notwithstanding today’s sell-off, the bias remains up and while a $4.5K move is not insignificant, sellers would need at least a 2nd day of the same to signal a reversal rather than a natural retracement.

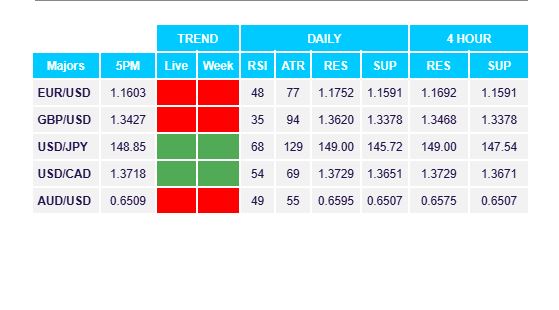

FX Pivot Levels