Market Highlights

1 - USD treads water as eyes turn back to trade; Trump hits Brasil with 50% tariff

2 - Gold up $12 to $3312; 10 yr yields down 7.9 bps; Crude flat at $68.32

3 - JPY leads, CAD lags; Bitcoin at all-time high, How high can it go?

4 - US equity close: strong finish as NVIDIA hits $4 trillion

5 - European major indices close solidly higher; gains led by France CAC

Daily Price Activity

Insights

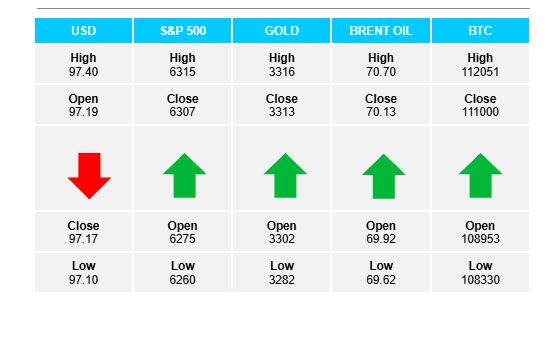

USD INDEX A gap higher to start and a brief push higher, yet buyers ran out of steam and prices retraced back to where the day started. The lack of direction confirmed with a doji-like candlestick. Resistance at 97.40 with support lower at 97.08. The uptrend remains in place with a 3rd consecutive higher low on the chart. Note the resistance area matches the support area from June 13. Buyers struggle to close above the 97.20 area.

S&P 500 The bias remains up as buyers maintain control with a higher high and higher low contributing to the sideways trend. Sellers continue to remain on the sidelines with neither side able to break out of the narrow sideways range. Resistance at 6315 with support set at 62.59.

GOLD Following an early push lower, buyers stepped in and did enough to win the day with a green candlestick confirming the higher close. Notwithstanding the push higher, the downtrend remains intact with a lower high and lower low on the daily chart. Support was established at $3282 with resistance set at $3316. Note that buyers again stepped in below the pivotal $3300 support area.

BRENT OIL Buyers were unable to hang on to early gains, but did just enough to close above the open with a higher low on the chart adding to the uptrend. Support sits at $69.59 with resistance matching yesterday’s high at $70.66. Significantly, buyers maintained above the $70 level.

BITCOIN A strong rally to the upside saw buyers break out of the sideways trend late in the day. Support rests at $108.3K with resistance established at $112.1K, just enough to set a record high edging slightly above the May 22nd level. Buyers will look to add to the move and aim above $112K, while sellers look down below $110K in an attempt to reverse the gains.

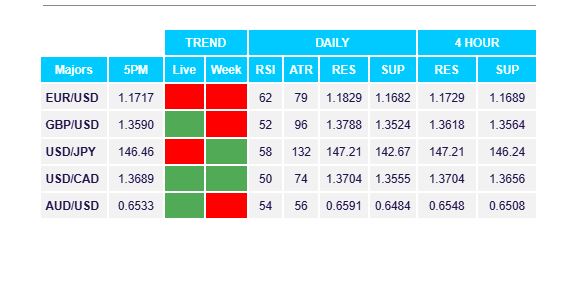

FX Pivot Levels