Market Highlights

1 - Trump says will begin sending letters on trade tariffs on Friday, Bessent: expect to see about 100 countries get minimum 10% reciprocal tax

2 - Non farm payrolls beat consensus, +147K v 110K expected

3 - WTI crude down $0.26 to $67.19; US 10 yr yields up 5.5 bps; gold down $28 to $3328

4 - USD leads, Yen lags; Hong Kong central bank intervenes to support HKD

5 - European indices close higher, DAX +0.47%, UK FTSE +0.55%, Ibex +0.98%

Daily Price Activity

Insights

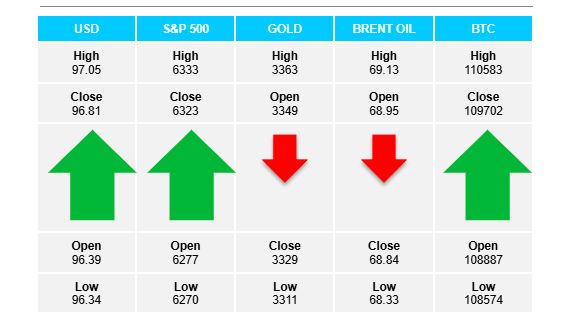

USD INDEX Strong job numbers along with congress passing a significant bill through the House, and the world’s reserve currency rallied. Buyers maintained control, added to yesterday’s gains and did enough to signal an uptrend on the shorter timeframes. Resistance was established at 97.06 with support lower at 96.32. The 96.00 area looks to be relevant going in to the new month - buyers have established a strong floor at the level, while sellers will aim below the number to resume the sell-off.

S&P 500 Buyers added to the well-established uptrend with a 10th consecutive up day - higher highs and higher lows on the chart. A new record high saw resistance established at 6334 with support sitting at 6271. Noteworthy that the USDX and S&P were in tandem, both moving higher. July has been scheduled as the date for new tariff/trade deals to be enacted, surely the major US equity markets will react accordingly.

GOLD Following 3 up days to start the week, the safe haven commodity was sold-off today with sellers in control. Resistance sits at $3369 with support at $3311. The inverse relationship between strong USD and weak gold played out through today’s session. The $3300 level could well prove to be pivotal as price activity hovers close to the current support area.

BRENT OIL Neither buyers or sellers made any move today as oil trades at $68.89 with limited activity in either direction. Resistance at $69.13 with support at $68.33. Buyers look up to the $70 mark, while sellers aim below $68.

BITCOIN Buyers added to yesterday’s strong rally with a higher high and higher low adding to the uptrend. A $2K move to the upside saw resistance established at $110.5K, with support set at $108.5K. Buyers will aim at the $112K record high while sellers look below $108K as a first goal in reversing the trend.

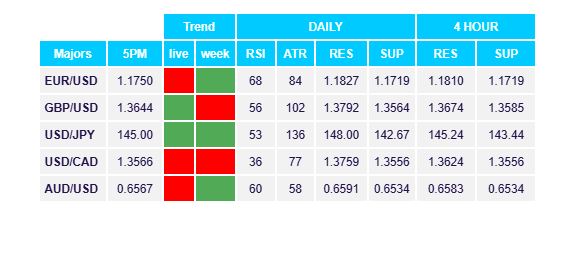

FX Pivot Levels