Market Highlights

1 - Powell might have cut but for tariffs; Trump: not extending the July 9 deadline

2 - Flow of funds move into Dow and small cap stocks; NASDAQ stocks shunned today; S&P unchanged

3 - Eurozone CPI inline; European indices close mostly lower, exception is UK FTSE up 0.28%

4 - US yields move higher, especially the shorter end; 30 yr did fall marginally

5 - Crude oil up $0.45 at $65.56; Gold up $36.98 to $3340; bitcoin down $1418 to $105.7K

Daily Price Activity

Insights

USD INDEX Buyers and sellers both had their say, only for price activity to close where it started - alongside yesterday’s close and today’s open. A doji-like candlestick confirms the stand-off. Resistance was established at 96.55 with support set at 95.96. The downtrend remains intact with a lower high and lower low on the daily charts. 2, 5 and 10 yr yields were up, while the 30 yr moved lower. The 96.00 area looks relevant with buyers aiming for 97 while sellers look to re-test below the 96 mark.

S&P 500 The equity index followed the same broad pattern as the USDX index with both sides testing higher and lower before settling alongside the open price. Another doji-like candlestick confirming the indecision. Resistance sits at 6261 with support at 6227. While buyers were unable to break above yesterday’s record high, sellers were not adding to the gentle retracement. Note the slightly higher low on the chart.

GOLD The metal added to yesterday’s gains with solid demand through the session. Following a gap up to start the day, buyers maintained above the $3300 level and went on to establish resistance at $3358, with support set at $3308. Buyers will aim for $3400 while demand for the safe haven commodity may take its cue from a weak USD. Broader picture does show the $3300 - $3350 range could be a comfort zone without fundamental triggers in either direction.

BRENT OIL The downtrend remains intact with price action contained within a narrow range between $66.32 and $67.48. The bias does look slightly tilted to the upside with shorter time-frames, 4hr and hourly, both pointing upward. Contributing factors remain the middle east ceasefire, as well as no new tariff news announcements.

BITCOIN Sellers were in control all through the session and did enough to signal a new downtrend with the EMAs crossing to the downside. Resistance set at $107.5K with support established lower at $105.4K. Following the record high set at $112K in May, note the 3 lower highs on the daily chart which does tilt the bias downwards on the daily charts. Sellers will aim below at the $100K level while buyers look up to $108K as the goal in attempting to reverse the trend.

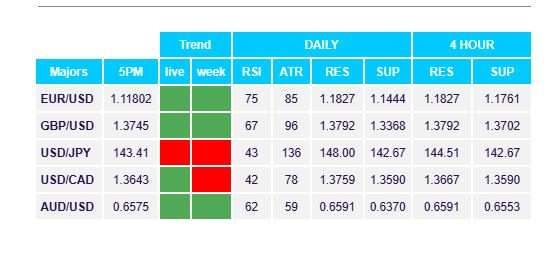

FX Pivot Levels