Market Highlights

1 - USD stays on the defensive

2 - JP Morgan tip a rate cut in December

3 - US stock markets finish mostly flat; European equities finish lower on the day

4 - Euro rises to fresh high since 2021

5 - US 10yr yields down 1bps, WTI crude up $0.86 to $65.23, gold up $9 to $3332

Daily Price Activity

Insights

USD INDEX The USD started on the front foot early, however the move higher was short lived as sellers took control and the USDX was sold off for the 3rd consecutive day. Lower highs, lower lows confirmed the downtrend. Sentiment surrounding the USD remains negative as the global currency’s safe haven status as the asset of choice is under question. Resistance is set at 97.79 with support established below at 97.22.

S&P 500 A stand-off at the current highs as buyers were again unsuccessful in an attempt to set a new record high. Resistance remains at 6161 with support closely tucked below at 6129. The bias and trend are both pointed upwards as sellers remain on the sidelines. The next driver could well be news on the tariff deals front.

GOLD Limited activity saw buyers and sellers trade within a narrow $28 range between $3309 and $3337. The bias remains pointed downwards with a lower high adding to the downward trend. While the $3300 area continues to hold as a solid floor, buyers will aim above $3350 as a first goal in reversing the trend.

BRENT OIL Oil stabilized today, closing alongside yesterdays close with buyers and sellers taking a breather. Resistance sits at $67.38 with support at $66.17. The current ceasefire levels are matching the prices we saw 2 weeks ago before the start of the middle east war.

BITCOIN A 3rd consecutive day of higher highs and higher lows as buyers added to the uptrend. Resistance sits at $108.1K with support below at $105.8K. Since bouncing up off the $100K level, sellers have stood on the sidelines as buyers look up to testing $110K on the way to eyeing the record $112K resistance. Sellers will look down at the $105K area in an attempt to reverse the trend.

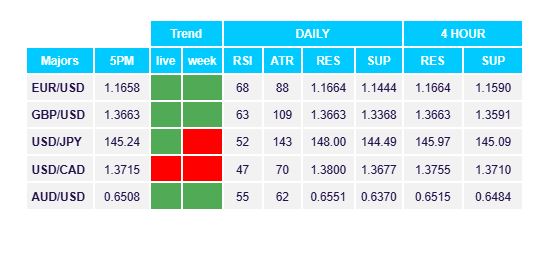

FX Pivot Levels