Market Highlights

1 - Powell tilts a little more dovish in testimony; US June consumer confidence 93.0 v 100.0 expected

2 - US stock markets finish strongly, near the all-time highs; tech and financial stocks lead the way

3 - Crude oil settles sharply lower for the 2nd consecutive day, down $3.50 at $65.01; gold down $44 at $3323; bitcoin up $400 at $105.8K

4 - In the US debt market yields moved lower which was another tailwind for stocks

5 - EU warns that a baseline Trump tariff would still lead to retaliation

Daily Price Activity

Insights

USD INDEX USD weakness continued today with the index pushing lower and in so doing signalled a downtrend as the EMAs crossed downward. The early sell-off started with a gap down, followed by sellers adding to the move in the Asian session. The dollar did fight back and show resilience through the US session. Resistance sits at 97.86 with support established at 97.29 on the downside. Sellers will aim to break below the 97 mark, while buyers look up to 98 as a first step to reverse the trend. Negative US sentiment continues to weigh on the global currency.

S&P 500 Equity markets rallied strongly today with buyers firmly in control. Todays rally in the S&P is the 4th attempt to break above 6150 since late last year. The de-escaltion in the middle east conflict, noteably the ceasefire agreement between Iran and Israel contributed to the positive sentiment surrounding the major equity markets today. While buyers maintain control demand may see new record highs in the upcoming sessions. Note the inverse relationship between the weak USD and strong equities. Resistance set at 6154 with support below at 6075. Sellers will look down at the 6000 level.

GOLD Sellers set the tone early, adding to yesterday’s losses before buyers stepped in at the pivotal $3300 level. Support was established at $3293 with resistance at $3356. Buyers recouped much of the early losses to close at $3323. Technically the downtrend remains intact with lower highs and lower lows on the chart. Sellers continue to look below $3300 while buyers look up to the $3400 level. It’s noteworthy that the safe haven commodity continues to give mixed signals as the middle east conflict has yet to create demand as sellers remain in control. In addition, the inverse relationship between a weak USD and strong gold has not played out in the traditional sense.

BRENT OIL A volatile trading day saw sellers prevail and add to yesterdays losses as the middle east conflict is now in ceasefire mode. Buyers briefly tested the $70 area on the upside before the positive sentiment outweighed previous supply concerns with sellers prevailing. Today’s activity saw prices continue to fall below the pre-conflict area. Resistance sits at $69.33 with support established at $65.86. The initial $12 move higher was based on fear while the 2-day selloff was based on expectation and sentiment rather than a fundamental/concrete change in the oil market.

BITCOIN Buyers held on today and added to yesterday’s breakout move to the upside with a (slightly) higher high and higher low adding to the uptrend. Resistance sits at $106.3K with support at $104.6K. The bias is tilted to the upside with the $109K seen as the next upside target. Sellers will aim below $104K to reverse the trend. Sentiment remains positive as the cryptocurrency bounced up off the $100K mark.

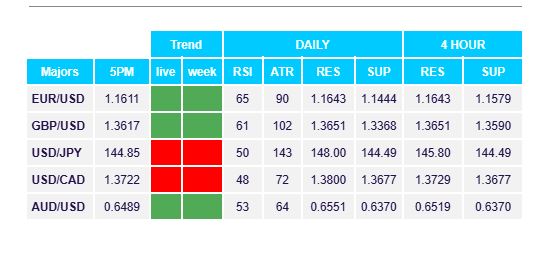

FX Pivot Levels