Market Highlights

1 - Trump expands 50% tariffs to appliances starting June 23; Trump: auto tariffs may go up in not distant future

2 - Gold up $35 to $3388; WTI crude down 4 cents to $68.11; US 10yr yields down 5.7 bps

3 - Euro breaks $1.16 as USD dips on soft US data; CHF leads as USD lags; Cable highest since 2022

4 - Trump: I don’t like that oil prices have gone up; Europe, Canada and Britain prepared to lower Russia oil price cap without USA

5 - White House: China tariff pause likely won’t be extended

Daily Price Activity

Insights

USD INDEX Sellers picked up from yesterday as the USD got sold off across the board. The index is trading at levels last seen in March 2022. While a slightly below consensus PPI report may have added to the sell-off, it seems that overall negative sentiment surrounding the USD is the main contributor to the lack of demand for the global currency. The US yields reflect the lack of confidence in US assets as a safe haven currency. Resistance sits higher at 98.07 with support below at 97.12.

S&P 500 Buyers came back to wipe out yesterday’s losses and keep the uptrend intact. Technically there is a contradiction as today’s candlestick shows a lower high and lower low on the charts. Resistance sits at 6098 with support set at 6039. Buyers will aim to break above the stubborn 6100 resistance area while sellers will aim below at the pivotal 6000 level.

GOLD Gold moved higher with a 4th consecutive day of higher highs and higher lows adding to the uptrend. Buyers have been held up at the $3400 area with resistance established at $3398. Support sits below at $3337. Gold continues to attract demand and move higher, confirming the commodity’s safe haven status. The traditional inverse relationship between gold and the USD, geopolitical uncertainty and the metals relatively quiet climb higher point to a potential breakout higher aimed at the record $3500 mark.

BRENT OIL An expected technical retracement following yesterday’s sharp breakout higher saw sellers establish support at $68.41 early in the Asian and European sessions. However, buyers stepped in and recouped the losses to re-establish support higher at $70.23. The fundamentals, ie. geopolitical tensions and supply concerns reflect that demand overrides supply as buyers remain firmly in control. The next target on the upside is the April 2nd high which reached the $75 mark. Note the current $68.41 support level was the springboard in March which led to the $75 resistance.

BITCOIN Sellers made a strong push lower from the start. Resistance sits at $108.8K (yesterday’s close) with support established at $105.8K. Noteworthy that the support is the level from which the sharp breakout higher started 3 days ago on June 9th. Sellers will look down at the $100K level on the way to reversing the trend, while buyers look back up at the $110K mark. The bias is down following the 2 day sell-off. Should buyers step in at current levels, todays low could develop as a higher low.

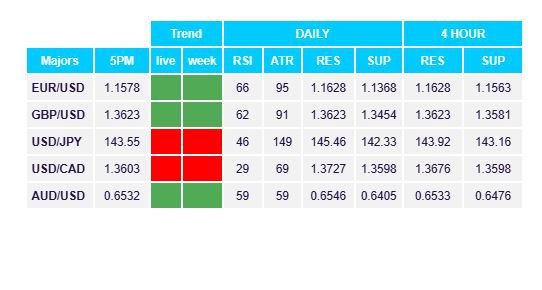

FX Pivot Levels