Market Highlights

1 - US indices close lower. Losers - AMZN, AAPL; Winners - SOFI, HOOD (Robin Hood Markets); European indices close the day mostly lower

2 - Gold pushed higher on a flight to safety +$30 at $3353; US yields close lower

3 - Crude futures settle at $68.15. Up $3.17 or 4.88%. Iran “no deal” major factor

4 - US-China trade deal offers limited progress with no new concrete trade deal

5 - Treasury secretary Bessent: Trump likely to push back July tariff deadline; Canada-US reportedly exchanging potential terms on economic and security deal

Daily Price Activity

Insights

USD INDEX The USD was sold across the board today with the USDX showing its lowest close since April 21st. Prices were contained below the descending trendline as the downtrend picked up steam. Resistance sits at 98.47 with support established at 98.02. US political unrest may have added to the negative sentiment surrounding the USD. While a bounce off the support area may offer potential opportunities from a technical perspective, fundamentals continue to weigh down the global reserve currency. Buyers will look to break above the descending trendline as sellers aim below 98.00.

S&P 500 The uptrend remains intact with a higher high and higher low on the charts. However, the contradiction is the red daily candlestick showing that sellers did win out overall as the index closed alongside yesterdays close price. Resistance was set at 6129 with support sitting at 6059. Without positive news relating to trade deals buyers struggled to maintain demand, although sellers have done little to reverse the trend.

GOLD The metal was resilient today and climbed steadily with buyers in control of price activity. The ascending trendline remains intact. Support sits at $3319 with resistance established at $3352. A weak U$, geopolitical uncertainty and technical studies all contributed to the safe haven commodity’s strong showing. Buyers will be aiming for $3400 on the upside while sellers will look down at the pivotal $3300 level. The traditional inverse relationship between gold and the USD confirmed.

BRENT OIL WOW! The breakout was setup both technically and fundamentally as oil started out at $66.44 support before racing up to close at $69.96. Its always relevant when support becomes resistance on the daily chart - Note the resistance level matches the support recorded at 29 Oct 2024. The significant $70 mark is now in play. While demand continues to dictate price activity, profit taking and natural retracements will be monitored on the shorter timeframes.

BITCOIN Sellers won out today with little demand as buyers were unable to replicate yesterdays bounce back pattern. Resistance at $110.3K for the 3rd consecutive day with support established at $108.4K. The uptrend remains in place with the bias still tilted to the upside. Buyers will be eyeing $112K resistance while sellers look to break below $108K in order to reverse the trend.

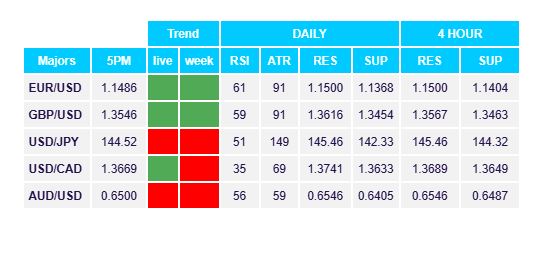

FX Pivot Levels