Market Highlights

1 - HSBC: Global stocks may rise short term (3 months), but tougher road ahead

2 - US stocks close higher led by NASDAQ +0.63%; hopes for an agreement between US and China helped support the market

3 - WTI crude down $0.54 to $64.75; US 10 yr yields down 1.6bps; oil tries to break out but gets reeled back in; gold flat at $3327; CAD leads, GBP lags

4 - Bitcoin climbs back above $110K to highest since May 27

5 - Goldman Sachs: rolling our EUR/USD forecasts higher

Daily Price Activity

Insights

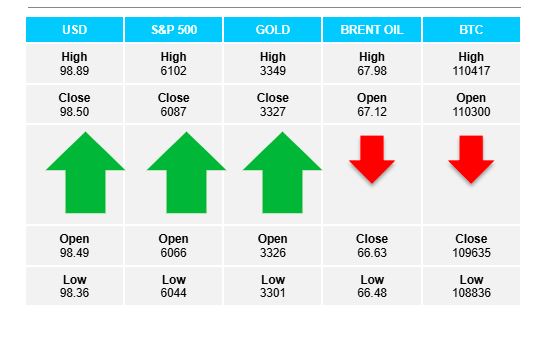

USD INDEX The index closed slightly higher, with little change in price and direction. The downtrend is tapering off sideways as neither buyers or sellers held onto intraday moves. Resistance sits at 98.91 with support lower at 98.37. Notwithstanding the higher high, the bias remains tilted to the downside.

S&P 500 The pattern continues with buyers continuing to add small gains to a gentle, but steady uptrend. A 3rd consecutive day of higher highs and higher lows as sellers continue to stand on the sidelines. Without any new tariff or trade deals announced, the mood remains optimistic as the US-China talks come to an end. US-Canada negotiations are also being reported as positive. New deals could possibly coincide with the upcoming G7 summit in Canada. Equity markets continue to move higher based on optimism and lack of new negative announcements. Resistance established at 6105 with support at 6042. An RSI reading at 69 could initiate a natural retracement.

GOLD The metal had a 2nd rest day with limited activity and a doji-like candlestick confirming the lack of direction. Resistance sits at $3348 with support established at $3301. Note the pivotal $3300 level continues to be relevant. Technically the contradiction signals a downtrend (EMAs crossed downwards), although todays candlestick reflects a higher high and higher low on the daily charts.

BRENT OIL Aside from a red candlestick confirming a lower close, the uptrend remains intact with todays candlestick adding to the series of higher highs and higher lows. Resistance was set at $67.98 with support resting lower at $66.44. As long as demand continues buyers will be looking above $68 with the $70 mark in sight. Sellers will aim to add to todays retracement and look below $66. As long as the fundamentals don’t change, it seems the bias will remain tilted to the upside.

BITCOIN Following yesterdays strong breakout higher, demand was limited as sellers won out with a gentle retracement, possibly aided by a bout of profit-taking. Sellers started out at the $110.3K resistance, going on to set support at $108.4K before buyers stepped in and went on to set todays close at $109.6K. Buyers will be aiming to test the $112K resistance with technicals, fundamentals and positive sentiment all contributing to the upward bias.

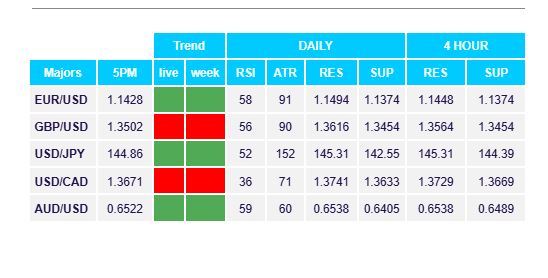

FX Pivot Levels