Market Highlights

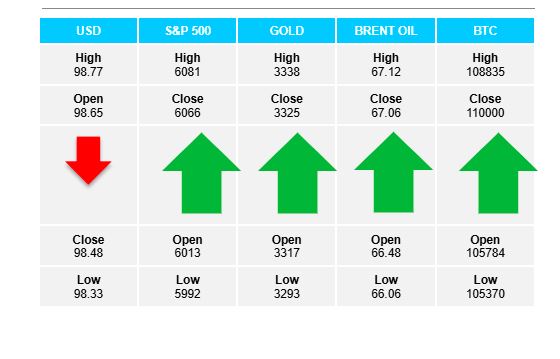

1 - Bitcoin has tested above $110K again

2 - Morgan Stanley holds the line on Tesla, sees long-term upside despite political situation

3 - US yields all close lower on the day, 10yr still above technical levels; WTI crude settle at $65.29, up $0.71

4 - US major indices close with modest changes; NASDAQ rises by 0.31%, DJ and S&P close little changed

5 - Citi forecasts Fed interest rates higher for longer, sees Sept cut (from July)

Daily Price Activity

Insights

USD INDEX The index had a quiet day with sellers winning out within a narrow range between 98.32 support and 98.77 resistance. The downtrend remains intact although the MAs are moving sideways with no new highs or lows in either direction. Buyers will aim at 99.00 while sellers look below 98.00 in order to initiate a new direction.

S&P 500 A strong day which gapped up to open with buyers/demand maintaining control throughout the session. Resistance was established at 6080 with support below at 5992. Trade activity above the 6000 mark adds to the upward bias. With no new tariff announcements and positive news surrounding potential trade deals, particularly with China, sellers remained on the sidelines. No news is good news continues to be the theme relating to the equity index. Todays market activity confirming the inverse relationship between a weak USD and strong equities.

GOLD A green daily candlestick…however the technicals are not that clear. The downtrend continued with a lower high and lower low on the charts. Note the gap up to open the day, followed by buyers confirming the slight demand and thereby managing a higher close on the day. Resistance sits at $3325 with support established at $3294. The $3300 level continues to look pivotal. Buyers may well see todays low as a higher low on the daily charts. The traditional inverse relationship between weak USD and strong gold held on, but only marginally. The EMAs point downward.

BRENT OIL Another strong day for oil as the uptrend picks up steam with a 3rd consecutive day of higher highs and higher lows. Support sits at $66.06 with price action maintaining at the established resistance at $67.16 with no pullback as the day came to a close. Buyers will be looking up at the $70 mark with the trend and bias both pointing up. Sellers will aim below $67 as a first goal in halting the move higher.

BITCOIN Buyers were in total control today with price action confirming the strong move higher. Support sits at $105.3K with resistance established at $110K late in the day. Demand for the cryptocurrency was maintained all through the session as sellers remained on the sidelines. Technically there appears to be room for further gains with no overbought signals yet in play - RSI reading is at 63. Buyers will be eyeing the $112K record high from last month (May). Note profit-taking could see pullbacks/retracements at these high prices. Traders could look at shorter time frames for entry and exit signals.

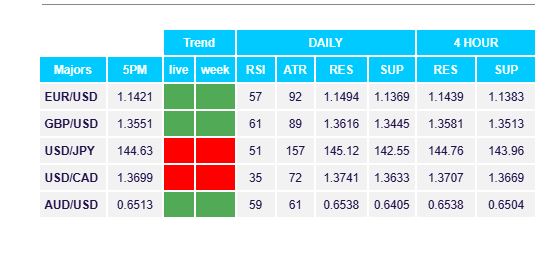

FX Pivot Levels